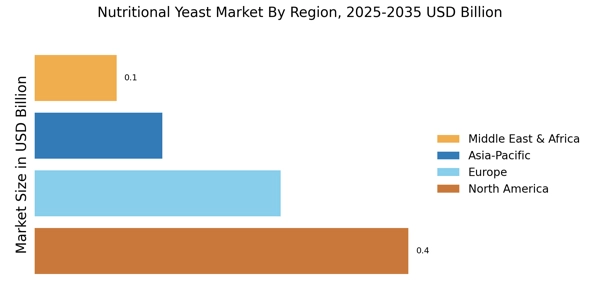

North America : Market Leader in Nutritional Yeast Market

North America is the largest market for nutritional yeast, holding approximately 45% of the global share. The region's growth is driven by increasing health consciousness, the rise of plant-based diets, and a growing demand for vegan protein sources. Regulatory support for health foods and supplements further catalyzes market expansion, with the FDA providing guidelines that encourage the use of nutritional yeast in various food products.

The United States is the primary contributor to this market, with key players like Bragg Live Food Products LLC and Bob's Red Mill Natural Foods leading the charge. The competitive landscape is characterized by a mix of established brands and emerging companies, all vying for market share. The presence of a robust distribution network and increasing online sales channels are also enhancing market accessibility, making nutritional yeast a staple in many households.

Europe : Emerging Market with Growth Potential

Europe is witnessing a significant increase in the demand for nutritional yeast, currently holding about 30% of the global market share. The growth is fueled by rising veganism, health trends favoring natural supplements, and regulatory frameworks that support health food innovations. The European Food Safety Authority (EFSA) has recognized nutritional yeast as a safe food ingredient, which further boosts consumer confidence and market growth.

Leading countries in this region include Germany, the UK, and France, where the market is characterized by a mix of local and international brands. Companies like Sundhed and Yeast Extracts are making notable contributions. The competitive landscape is evolving, with an increasing number of startups entering the market, driven by consumer demand for organic and non-GMO products. This dynamic environment is expected to foster innovation and expand product offerings.

Asia-Pacific : Rapid Growth in Health Awareness

The Asia-Pacific region is emerging as a significant player in the nutritional yeast market, currently accounting for about 15% of the global share. The growth is primarily driven by increasing health awareness, rising disposable incomes, and a shift towards vegetarian and vegan diets. Regulatory bodies in countries like Australia and New Zealand are also promoting the use of nutritional yeast as a health supplement, which is further propelling market growth.

Key countries in this region include Australia, Japan, and India, where the market is becoming increasingly competitive. Local brands are beginning to emerge, alongside established players from North America and Europe. The presence of companies like NOW Foods and Anthony's Goods is notable, as they expand their reach into this burgeoning market. The competitive landscape is characterized by a mix of traditional and modern retail channels, enhancing product availability.

Middle East and Africa : Untapped Market with Potential

The Middle East and Africa represent an untapped market for nutritional yeast, currently holding about 10% of the global share. The growth potential is significant, driven by increasing health awareness and a rising trend towards plant-based diets. Regulatory frameworks in countries like South Africa are beginning to recognize nutritional yeast as a valuable food ingredient, which could catalyze market expansion in the coming years.

Leading countries in this region include South Africa and the UAE, where the market is still developing. The competitive landscape is relatively nascent, with few established players, presenting opportunities for new entrants. As consumer awareness grows, companies are likely to invest in marketing and distribution strategies to capture market share. The presence of international brands could also stimulate local production and innovation in this sector.