Rising Energy Demand

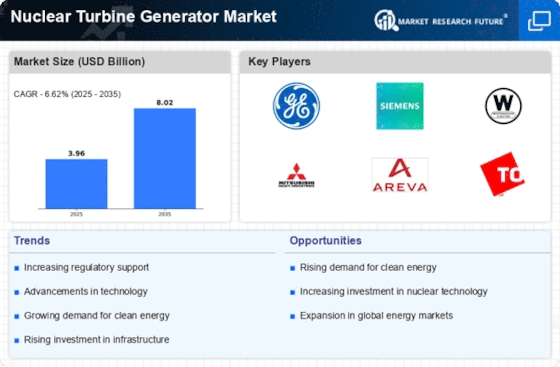

The increasing The Nuclear Turbine Generator Industry. As populations grow and economies expand, the need for reliable and sustainable energy sources intensifies. Nuclear power, known for its ability to generate large amounts of electricity with minimal greenhouse gas emissions, is becoming increasingly attractive. According to recent data, nuclear energy contributes approximately 10% of the world's electricity supply. This demand is expected to rise, particularly in developing regions where energy infrastructure is still evolving. The Nuclear Turbine Generator Market is poised to benefit from this trend, as more countries look to nuclear energy as a viable solution to meet their energy needs.

Regulatory Frameworks

Regulatory frameworks play a crucial role in shaping the Nuclear Turbine Generator Market. Governments worldwide are establishing policies and regulations that support the safe and efficient operation of nuclear power plants. These frameworks are designed to ensure safety, environmental protection, and public acceptance of nuclear energy. Recent trends indicate that many countries are streamlining regulatory processes to facilitate the development of new nuclear projects. This supportive regulatory environment is likely to encourage investment and innovation within the Nuclear Turbine Generator Market, as stakeholders seek to navigate the complexities of nuclear energy deployment.

Technological Innovations

Technological innovations are reshaping the Nuclear Turbine Generator Market. Advances in turbine design, materials, and efficiency are enhancing the performance of nuclear power plants. Innovations such as small modular reactors (SMRs) and next-generation reactors are gaining traction, offering improved safety and efficiency. These developments not only reduce operational costs but also make nuclear energy more competitive with other energy sources. The integration of digital technologies and automation in nuclear facilities is further optimizing performance and reliability. As these technologies continue to evolve, the Nuclear Turbine Generator Market is expected to benefit from increased adoption and modernization of nuclear power plants.

Decarbonization Initiatives

Decarbonization initiatives are increasingly influencing the Nuclear Turbine Generator Market. As countries commit to reducing carbon emissions in line with international climate agreements, nuclear energy emerges as a crucial component of their energy strategies. The transition to low-carbon energy sources is driving investments in nuclear technology, which is seen as a reliable alternative to fossil fuels. Data suggests that nuclear power can significantly reduce carbon footprints, making it an attractive option for nations aiming to meet their climate goals. Consequently, the Nuclear Turbine Generator Market is likely to experience growth as more governments prioritize nuclear energy in their decarbonization efforts.

Investment in Nuclear Infrastructure

Investment in nuclear infrastructure is a significant driver for the Nuclear Turbine Generator Market. Governments and private entities are recognizing the importance of modernizing existing nuclear facilities and constructing new ones to enhance energy security. Recent reports indicate that investments in nuclear energy infrastructure are projected to reach several billion dollars over the next decade. This influx of capital is likely to facilitate advancements in turbine technology, improve efficiency, and reduce operational costs. As nations strive to achieve energy independence and sustainability, the Nuclear Turbine Generator Market stands to gain from these substantial investments, fostering growth and innovation.