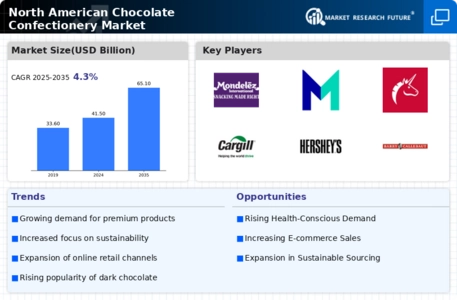

The competitive dynamics within the Chocolate Confectionery Market in North America are characterized by a blend of innovation, strategic partnerships, and a focus on sustainability. Key players such as Mars, Inc. (US), Mondelez International, Inc. (US), and Hershey Company (US) are actively shaping the landscape through various operational strategies. Mars, Inc. (US) emphasizes product innovation and sustainability, aiming to enhance its market share by introducing new flavors and eco-friendly packaging. Mondelez International, Inc. (US) focuses on expanding its digital presence and e-commerce capabilities, which appears to be a critical driver of growth in the current market. Hershey Company (US) is also investing in regional expansion and diversifying its product portfolio, which collectively influences the competitive environment by fostering a culture of continuous improvement and responsiveness to consumer trends.

The market structure is moderately fragmented, with several key players exerting considerable influence. Business tactics such as localizing manufacturing and optimizing supply chains are prevalent among these companies. For instance, Mars, Inc. (US) has localized its production facilities to reduce transportation costs and enhance supply chain efficiency. This approach not only improves operational effectiveness but also allows for quicker responses to market demands, thereby strengthening their competitive position.

In December 2025, Mondelez International, Inc. (US) announced a strategic partnership with a leading tech firm to enhance its digital marketing capabilities. This move is significant as it aligns with the growing trend of digitalization in the industry, enabling Mondelez to better engage with consumers through targeted marketing campaigns. The partnership is expected to bolster its online sales, which have become increasingly vital in the current retail environment.

In November 2025, Hershey Company (US) launched a new line of organic chocolate products, reflecting a growing consumer preference for healthier options. This strategic initiative not only caters to the rising demand for organic products but also positions Hershey as a leader in the health-conscious segment of the market. The introduction of these products is likely to attract a new demographic of consumers, thereby expanding their market reach.

In October 2025, Ferrero USA, Inc. (US) acquired a smaller chocolate brand known for its artisanal products. This acquisition is indicative of Ferrero's strategy to diversify its product offerings and tap into the premium chocolate segment. By integrating this brand into its portfolio, Ferrero aims to enhance its competitive edge and appeal to consumers seeking high-quality, unique chocolate experiences.

As of January 2026, current trends in the Chocolate Confectionery Market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate to enhance their competitive positioning. The shift from price-based competition to a focus on innovation, technology, and supply chain reliability is evident. Moving forward, differentiation will likely hinge on the ability to innovate and adapt to changing consumer preferences, with sustainability becoming a core component of competitive strategy.