Rising Security Concerns

The increasing prevalence of security threats in various sectors is a primary driver for the video surveillance-as-a-service market. Organizations are increasingly investing in surveillance solutions to mitigate risks associated with theft, vandalism, and unauthorized access. In North America, the demand for advanced security measures has surged, with the market projected to grow at a CAGR of approximately 15% over the next five years. This growth is fueled by the need for real-time monitoring and rapid response capabilities, which video surveillance-as-a-service solutions provide. As businesses and institutions prioritize safety, the adoption of these services is likely to expand, reflecting a broader trend towards enhanced security protocols across industries.

Regulatory Compliance and Standards

The necessity for compliance with various regulatory frameworks is a crucial driver for the video surveillance-as-a-service market. Organizations in North America are increasingly required to adhere to regulations concerning data protection and privacy. This has led to a heightened demand for surveillance solutions that not only meet security needs but also comply with legal standards. The market is likely to see a surge in services that offer built-in compliance features, ensuring that organizations can operate within legal boundaries while maintaining effective surveillance. As regulatory scrutiny intensifies, the market could witness a growth rate of around 12% annually, reflecting the importance of compliance in shaping purchasing decisions.

Increased Demand for Remote Monitoring

The growing trend of remote work and the need for flexible security solutions are driving the video surveillance-as-a-service market. Organizations are increasingly seeking systems that allow for remote access and monitoring capabilities, enabling them to oversee operations from anywhere. This demand is particularly pronounced in sectors such as retail and logistics, where real-time oversight is critical. In North America, the market is projected to expand significantly, with remote monitoring solutions expected to capture a substantial share of the overall market. Estimates suggest that by 2026, remote monitoring could account for nearly 40% of all video surveillance services, highlighting the shift towards more adaptable security solutions.

Cost-Effectiveness of Subscription Models

The shift towards subscription-based models in the video surveillance-as-a-service market is transforming how organizations approach security investments. By opting for a service model, businesses can avoid the high upfront costs associated with traditional surveillance systems. Instead, they can allocate resources more efficiently, paying a predictable monthly fee. This model not only reduces capital expenditure but also allows for easier upgrades and maintenance. In North America, the market is witnessing a notable increase in adoption rates, with estimates suggesting that subscription services could account for over 60% of the market share by 2026. This trend indicates a growing preference for flexible financial solutions in security management.

Technological Advancements in Surveillance

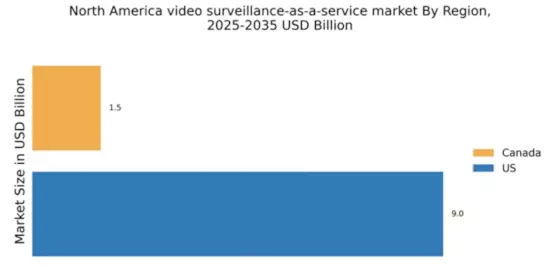

Technological innovations are significantly influencing the video surveillance-as-a-service market. The integration of high-definition cameras, cloud storage, and advanced analytics is enhancing the capabilities of surveillance systems. In North America, the market is experiencing a rapid evolution, with the introduction of features such as facial recognition and motion detection. These advancements not only improve the effectiveness of surveillance but also provide organizations with actionable insights. As technology continues to evolve, it is anticipated that the market will expand, with projections indicating a potential increase in market size to over $10 billion by 2027. This growth underscores the importance of staying ahead in technological adoption for competitive advantage.

Leave a Comment