Rising Security Concerns

The increasing incidence of crime and security threats in urban areas of India has led to a heightened demand for effective surveillance solutions. As businesses and residential complexes seek to enhance their security measures, the video surveillance-as-a-service market is expected to experience significant growth. According to recent estimates, the market is projected to expand at a CAGR of approximately 25% over the next five years. This surge is driven by the need for real-time monitoring and rapid response capabilities, which are essential in mitigating risks associated with theft, vandalism, and other criminal activities. Consequently, organizations are increasingly opting for video surveillance-as-a-service solutions that offer flexibility, scalability, and cost-effectiveness, thereby transforming the security landscape in India.

Technological Advancements

Rapid advancements in technology, particularly in artificial intelligence (AI) and machine learning, are reshaping the video surveillance-as-a-service market. These technologies enable enhanced analytics, facial recognition, and behavior analysis, which are becoming increasingly vital for effective surveillance. As organizations in India adopt these cutting-edge solutions, the market is likely to witness substantial growth. The integration of AI-driven analytics can improve incident response times and reduce false alarms, making surveillance systems more efficient. Furthermore, the increasing availability of high-speed internet and cloud computing capabilities supports the deployment of sophisticated video surveillance solutions, thereby driving the market forward.

Government Initiatives and Investments

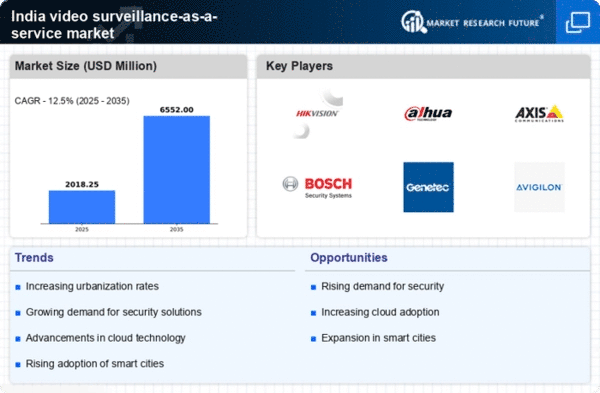

The Indian government has been actively promoting smart city initiatives, which include the implementation of advanced surveillance systems. These initiatives aim to enhance public safety and improve urban infrastructure. The video surveillance-as-a-service market is likely to benefit from these investments, as municipalities and local authorities seek to deploy comprehensive surveillance solutions. With an estimated budget allocation of over $1 billion for smart city projects, the demand for video surveillance services is expected to rise significantly. This government backing not only provides financial support but also encourages private sector participation, fostering innovation and competition within the video surveillance-as-a-service market.

Cost-Effectiveness of Subscription Models

The shift from traditional capital expenditure models to subscription-based services is transforming the video surveillance-as-a-service market. This model allows businesses and organizations in India to access advanced surveillance technologies without the burden of high upfront costs. By paying a monthly or annual fee, users can benefit from continuous updates, maintenance, and support. This flexibility is particularly appealing to small and medium-sized enterprises (SMEs) that may lack the resources for large-scale installations. As a result, the video surveillance-as-a-service market is likely to see increased adoption among SMEs, contributing to overall market growth.

Growing Demand for Remote Monitoring Solutions

The need for remote monitoring solutions is becoming increasingly pronounced in various sectors, including retail, healthcare, and logistics. Organizations are recognizing the value of being able to monitor their premises from anywhere, at any time. This trend is driving the video surveillance-as-a-service market, as businesses seek to implement systems that offer remote access and control. The ability to view live feeds and receive alerts on mobile devices enhances security and operational efficiency. As more companies prioritize remote monitoring capabilities, the demand for video surveillance-as-a-service solutions is expected to rise, further propelling market growth.

Leave a Comment