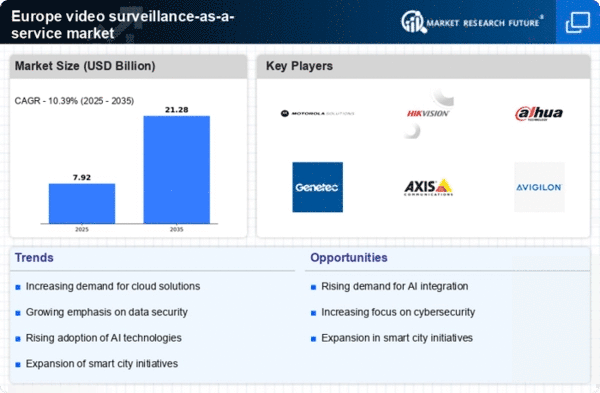

The video surveillance-as-a-service market in Europe is characterized by a dynamic competitive landscape, driven by technological advancements and increasing demand for security solutions. Key players such as Motorola Solutions (US), Hikvision (CN), and Axis Communications (SE) are at the forefront, each adopting distinct strategies to enhance their market presence. Motorola Solutions (US) emphasizes innovation through the integration of AI and machine learning into its surveillance offerings, aiming to provide advanced analytics and real-time monitoring capabilities. Meanwhile, Hikvision (CN) focuses on regional expansion, leveraging its extensive product portfolio to penetrate various European markets, thereby enhancing its competitive edge. Axis Communications (SE) is known for its commitment to sustainability, integrating eco-friendly practices into its operations, which resonates well with the growing consumer preference for environmentally responsible solutions.

The business tactics employed by these companies reflect a concerted effort to optimize supply chains and localize manufacturing processes. The market structure appears moderately fragmented, with several players vying for market share, yet the influence of major companies remains substantial. This competitive environment fosters innovation and drives companies to differentiate their offerings, ultimately benefiting consumers through enhanced product features and services.

In October 2025, Hikvision (CN) announced a strategic partnership with a leading European telecommunications provider to enhance its cloud-based surveillance solutions. This collaboration is poised to expand Hikvision's reach in the region, allowing for improved service delivery and customer engagement. The partnership underscores the importance of leveraging local expertise to navigate the complexities of the European market, potentially positioning Hikvision as a more formidable competitor.

In September 2025, Axis Communications (SE) launched a new line of AI-powered cameras designed specifically for urban environments. This product introduction not only showcases Axis's commitment to innovation but also addresses the growing demand for smart city solutions. By focusing on urban applications, Axis aims to capture a significant share of the market that prioritizes integrated surveillance systems, thereby reinforcing its competitive positioning.

In November 2025, Motorola Solutions (US) unveiled a new cloud-based analytics platform that integrates seamlessly with its existing surveillance systems. This development is indicative of the company's strategy to enhance its technological capabilities, providing clients with advanced data insights and operational efficiencies. The introduction of this platform may serve to solidify Motorola's reputation as a leader in the video surveillance-as-a-service market, particularly as organizations increasingly seek data-driven solutions.

As of November 2025, the competitive trends within the market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in enhancing their service offerings. Looking ahead, it is likely that competitive differentiation will evolve, shifting from traditional price-based competition to a focus on innovation, technological advancements, and supply chain reliability. This transition may ultimately reshape the landscape, compelling companies to invest in cutting-edge solutions that meet the evolving needs of consumers.