Health and Wellness Trends

The North America Coffee Pods And Capsules Market is increasingly influenced by the rising health and wellness trends among consumers. There is a growing awareness regarding the health benefits of coffee, including its potential to enhance cognitive function and boost metabolism. As a result, many consumers are seeking out specialty coffee pods that offer organic, low-calorie, or functional ingredients. Market data suggests that the demand for health-oriented coffee products has increased by approximately 30% in recent years. This shift is prompting manufacturers to innovate and diversify their product offerings, thereby aligning with the health-conscious preferences of consumers in the North America Coffee Pods And Capsules Market.

Expansion of E-commerce Platforms

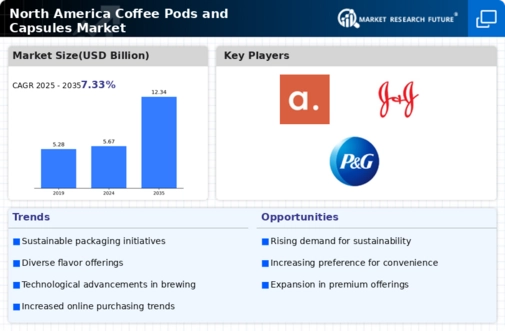

The North America Coffee Pods And Capsules Market is witnessing a significant transformation due to the expansion of e-commerce platforms. Online retailing has become a crucial channel for coffee pod sales, with many consumers opting to purchase their favorite brands from the comfort of their homes. Recent statistics indicate that e-commerce sales of coffee pods have surged by over 25% in the past year, reflecting a shift in consumer buying behavior. This trend is further supported by the convenience of subscription services, which allow consumers to receive regular deliveries of their preferred coffee products. Consequently, the growth of e-commerce is likely to play a pivotal role in shaping the future landscape of the North America Coffee Pods And Capsules Market.

Sustainability and Eco-Friendly Practices

The North America Coffee Pods And Capsules Market is increasingly prioritizing sustainability and eco-friendly practices. As consumers become more environmentally conscious, there is a growing demand for coffee pods that are recyclable or made from biodegradable materials. Recent surveys indicate that nearly 70% of consumers are willing to pay a premium for sustainable coffee products. This trend is prompting manufacturers to invest in sustainable sourcing and packaging solutions, thereby enhancing their brand reputation and appeal. The emphasis on sustainability is likely to shape product development strategies within the North America Coffee Pods And Capsules Market, as companies strive to meet the evolving expectations of environmentally aware consumers.

Growing Consumer Preference for Convenience

The North America Coffee Pods And Capsules Market is experiencing a notable shift towards convenience-driven consumption. Busy lifestyles and the increasing demand for quick, hassle-free coffee solutions are propelling the popularity of coffee pods and capsules. According to recent data, approximately 60% of coffee drinkers in North America prefer single-serve options due to their ease of use and minimal preparation time. This trend is particularly pronounced among millennials and working professionals, who prioritize efficiency in their daily routines. As a result, manufacturers are focusing on developing innovative pod designs and flavors to cater to this growing consumer preference, thereby enhancing their market presence in the North America Coffee Pods And Capsules Market.

Technological Innovations in Coffee Brewing

The North America Coffee Pods And Capsules Market is benefiting from technological innovations in coffee brewing methods. Advances in brewing technology have led to the development of machines that optimize flavor extraction and enhance the overall coffee experience. For instance, new brewing systems allow consumers to customize their coffee strength and temperature, catering to individual preferences. Market Research Future indicates that the adoption of advanced brewing technologies has increased by approximately 20% among consumers in North America. This trend not only elevates the quality of coffee but also encourages consumers to explore a wider variety of coffee pods and capsules, thereby driving growth in the North America Coffee Pods And Capsules Market.