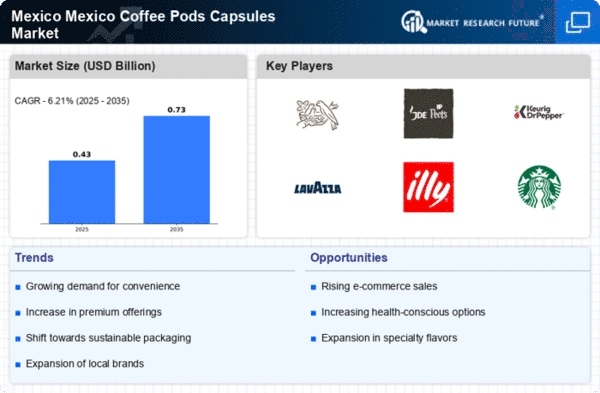

The Coffee Pods and Capsules Market in Mexico is characterized by a dynamic competitive landscape, driven by evolving consumer preferences and a growing inclination towards convenience. Major players such as Nestlé (MX), JDE Peet's (MX), and Keurig Dr Pepper (MX) are actively shaping the market through strategic initiatives focused on innovation and regional expansion. Nestlé (MX) emphasizes sustainability in its product offerings, while JDE Peet's (MX) leverages its extensive distribution network to enhance market penetration. Keurig Dr Pepper (MX) appears to be concentrating on digital transformation, enhancing customer engagement through technology-driven solutions. Collectively, these strategies contribute to a moderately fragmented market structure, where competition is intensifying as companies seek to differentiate themselves through unique value propositions.

In terms of business tactics, localizing manufacturing and optimizing supply chains are pivotal for these companies. The competitive structure remains moderately fragmented, with key players exerting considerable influence over market dynamics. The presence of local brands, such as Café de Olla (MX) and Café Punta del Cielo (MX), further enriches the competitive environment, as they cater to regional tastes and preferences, thereby enhancing consumer loyalty.

In December 2025, Nestlé (MX) announced a partnership with a local coffee cooperative to source sustainably grown beans, aiming to enhance its product line's sustainability credentials. This strategic move not only aligns with global sustainability trends but also strengthens Nestlé's local supply chain, potentially improving its market position amidst increasing consumer demand for ethically sourced products. The partnership may also foster community development, enhancing brand reputation.

In November 2025, JDE Peet's (MX) launched a new line of coffee pods designed specifically for the Mexican market, featuring local flavors and blends. This initiative reflects JDE Peet's commitment to catering to regional preferences, which could significantly bolster its market share. By tapping into local tastes, the company positions itself as a more relatable brand, likely enhancing customer loyalty and driving sales growth.

In October 2025, Keurig Dr Pepper (MX) unveiled a digital platform aimed at enhancing customer interaction and streamlining the purchasing process. This platform is expected to facilitate personalized marketing efforts, allowing the company to better understand consumer preferences and tailor its offerings accordingly. The integration of technology into customer engagement strategies may provide a competitive edge in an increasingly digital marketplace.

As of January 2026, current trends in the Coffee Pods and Capsules Market are heavily influenced by digitalization, sustainability, and the integration of artificial intelligence (AI) in operations. Strategic alliances are becoming increasingly vital, as companies collaborate to enhance their technological capabilities and sustainability efforts. Looking ahead, competitive differentiation is likely to evolve, with a pronounced shift from price-based competition to a focus on innovation, technology, and supply chain reliability. This transition may redefine market dynamics, compelling companies to invest in R&D and sustainable practices to maintain a competitive edge.