Health and Wellness Trends

Health and wellness trends are increasingly influencing consumer choices within the France coffee pods capsules market. As individuals become more health-conscious, there is a rising interest in coffee products that offer functional benefits, such as organic or low-acid options. Recent surveys indicate that approximately 25% of French consumers prioritize health-related attributes when selecting coffee products. This trend has prompted manufacturers to innovate by introducing coffee pods that incorporate health-enhancing ingredients, such as adaptogens or superfoods. Furthermore, the demand for decaffeinated and low-calorie options is on the rise, reflecting a broader shift towards healthier lifestyles. As the France coffee pods capsules market adapts to these evolving consumer preferences, it is likely to see an increase in the availability of health-oriented coffee products.

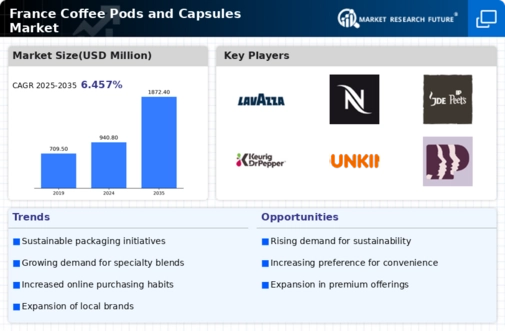

Growing Consumer Demand for Convenience

The France coffee pods capsules market is experiencing a notable surge in consumer demand for convenience. As lifestyles become increasingly fast-paced, consumers are gravitating towards products that offer quick and easy preparation. Coffee pods and capsules provide an efficient solution, allowing users to brew a fresh cup of coffee in mere seconds. According to recent data, the market for coffee pods in France has expanded significantly, with sales figures indicating a growth rate of approximately 10% annually. This trend suggests that consumers prioritize convenience, driving manufacturers to innovate and diversify their offerings to meet this demand. The rise of single-serve coffee machines further complements this trend, as they are designed specifically for use with coffee pods, thereby enhancing the overall consumer experience in the France coffee pods capsules market.

Diverse Flavor Profiles and Customization

The France coffee pods capsules market is witnessing a trend towards diverse flavor profiles and customization options. Consumers are no longer satisfied with traditional coffee flavors; they are seeking unique and exotic blends that cater to their individual preferences. This shift has prompted manufacturers to expand their product lines, offering a wide array of flavors, including seasonal and limited-edition options. Market data suggests that flavored coffee pods account for a significant portion of sales, with a growing number of consumers experimenting with different tastes. Additionally, the rise of subscription services allows consumers to personalize their coffee experiences by selecting specific flavors and blends. This trend towards customization not only enhances consumer satisfaction but also drives brand loyalty within the France coffee pods capsules market.

Sustainability and Eco-Friendly Practices

Sustainability has emerged as a pivotal driver within the France coffee pods capsules market. As environmental concerns gain traction among consumers, there is a growing preference for eco-friendly products. Many manufacturers are responding by developing biodegradable or recyclable coffee pods, which align with the increasing consumer awareness regarding waste management. Recent statistics indicate that nearly 30% of French consumers are willing to pay a premium for sustainable coffee options. This shift towards sustainability not only reflects changing consumer values but also compels companies to adopt greener practices in their production processes. Consequently, the France coffee pods capsules market is likely to witness a transformation as brands strive to balance convenience with environmental responsibility, potentially reshaping consumer purchasing behaviors.

Technological Innovations in Coffee Brewing

Technological advancements play a crucial role in shaping the France coffee pods capsules market. Innovations in coffee brewing technology have led to the development of machines that enhance the brewing process, ensuring optimal flavor extraction and consistency. For instance, advancements in pressure and temperature control have allowed manufacturers to create coffee pods that deliver a superior taste experience. Furthermore, smart coffee machines that can be controlled via mobile applications are gaining popularity, appealing to tech-savvy consumers. This integration of technology not only improves the quality of coffee but also enhances user convenience, thereby driving sales in the France coffee pods capsules market. As consumers increasingly seek high-quality coffee experiences at home, the demand for technologically advanced brewing solutions is expected to rise.