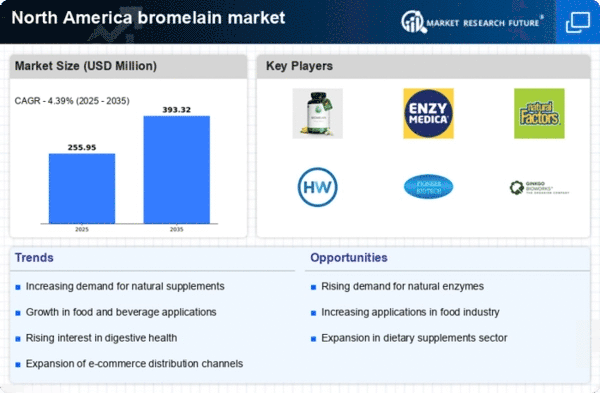

Expansion of E-commerce Platforms

The expansion of e-commerce platforms is transforming the way consumers access bromelain products in the bromelain market. With the rise of online shopping, consumers can easily find and purchase bromelain supplements and food products from the comfort of their homes. This shift is particularly relevant in North America, where online retail sales are projected to exceed $1 trillion by 2025. The convenience and accessibility of e-commerce are likely to drive sales of bromelain products, as consumers increasingly prefer the ease of online transactions over traditional retail methods. This trend may lead to a broader market reach for bromelain manufacturers.

Growing Awareness of Health Benefits

The increasing awareness of the health benefits associated with bromelain is a key driver in the bromelain market. Consumers are becoming more informed about the potential anti-inflammatory and digestive properties of bromelain, which is derived from pineapples. This awareness is leading to a surge in demand for bromelain supplements and products. According to recent data, the market for dietary supplements in North America is projected to reach approximately $50 billion by 2026, with natural ingredients like bromelain gaining traction. As consumers prioritize health and wellness, the bromelain market is likely to experience significant growth, driven by this heightened interest in natural health solutions.

Rising Popularity of Functional Foods

The trend towards functional foods is significantly impacting the bromelain market. Consumers are increasingly seeking foods that offer health benefits beyond basic nutrition. Bromelain, known for its potential to aid digestion and reduce inflammation, is being incorporated into various food products, including beverages and snacks. The functional food market in North America is expected to grow at a CAGR of around 8% over the next few years, indicating a robust opportunity for bromelain-infused products. This shift in consumer preferences towards health-oriented food options is likely to bolster the demand for bromelain, thereby enhancing its market presence.

Advancements in Extraction Technologies

Technological advancements in the extraction and processing of bromelain are driving efficiency and product quality in the bromelain market. Innovations in extraction methods, such as enzyme-assisted extraction and supercritical fluid extraction, are enabling manufacturers to obtain higher yields of bromelain while preserving its bioactive properties. This improvement in production processes is likely to reduce costs and enhance the availability of bromelain products in North America. As the market for natural enzymes continues to expand, the bromelain market stands to benefit from these advancements, potentially leading to increased adoption across various industries.

Increased Research and Development Activities

The surge in research and development activities related to bromelain is a significant driver in the bromelain market. Ongoing studies are exploring the various applications of bromelain in health and wellness, including its potential role in sports nutrition and post-operative recovery. As research continues to unveil new benefits and uses for bromelain, the market is likely to see an influx of innovative products. Funding for research in the health supplement sector is on the rise, with North American investments in health-related R&D expected to reach $200 billion by 2027. This focus on innovation is likely to enhance the profile of bromelain, attracting both consumers and manufacturers.