Rise in Disposable Income

An increase in disposable income among families in North America is significantly impacting the baby toys market. As parents have more financial resources, they are more inclined to invest in high-quality, innovative toys for their children. This trend is particularly evident in urban areas, where families are willing to spend more on premium products. Reports suggest that the average spending on baby toys has risen by 20% over the past three years, indicating a robust market potential. This rise in disposable income is likely to continue influencing purchasing decisions, thereby propelling growth in the baby toys market.

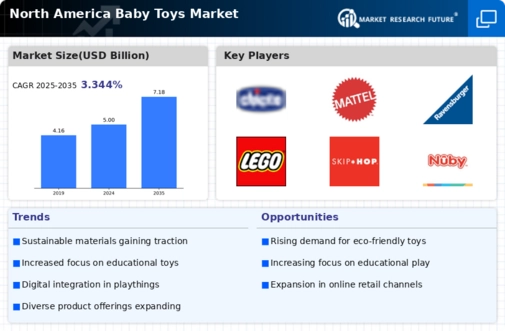

Focus on Eco-Friendly Products

The baby toys market is witnessing a growing focus on eco-friendly products as consumers become more environmentally conscious. Parents are increasingly seeking toys made from sustainable materials that are safe for their children and the planet. This trend is reflected in the rising sales of organic and biodegradable toys, which are projected to grow by 25% in the next five years. As manufacturers respond to this demand by developing eco-friendly options, the baby toys market is likely to see a significant shift towards sustainability, appealing to a broader consumer base.

Growing Awareness of Child Development

The baby toys market is benefiting from a growing awareness of child development among parents. There is an increasing understanding of the importance of play in cognitive and emotional development during early childhood. Consequently, parents are seeking toys that promote learning and skill development. This trend is reflected in the rising demand for educational toys, which are projected to account for over 30% of the total baby toys market by 2026. As parents prioritize developmental benefits, manufacturers are responding by creating toys that align with educational standards, further driving growth in the baby toys market.

Technological Advancements in Toy Design

The baby toys market is experiencing a notable shift due to technological advancements in toy design. Innovations such as interactive and smart toys are becoming increasingly prevalent, appealing to tech-savvy parents. These toys often incorporate features like sensors, connectivity, and educational content, enhancing the play experience. In 2025, it is estimated that the market for smart toys will reach approximately $2 billion in North America, reflecting a growth rate of around 15% annually. This trend indicates a strong consumer preference for toys that not only entertain but also educate, thereby driving demand in the baby toys market.

Influence of Social Media and Online Reviews

The baby toys market is increasingly influenced by social media and online reviews. Parents often turn to platforms like Instagram and Facebook for recommendations on the best toys for their children. This trend has led to a surge in the popularity of brands that effectively engage with consumers through social media marketing. In 2025, it is estimated that nearly 40% of parents rely on social media for purchasing decisions related to baby toys. This shift in consumer behavior is prompting manufacturers to enhance their online presence and marketing strategies, thereby impacting sales in the baby toys market.