Increasing Birth Rates

The baby toys market in Germany is experiencing growth due to a notable increase in birth rates. Recent statistics indicate that the birth rate has risen to approximately 1.6 children per woman, which is a positive trend for the baby toys market. This demographic shift suggests a larger consumer base for baby products, including toys. As more families are formed, the demand for a variety of baby toys is likely to expand. Parents are increasingly seeking toys that promote developmental skills, safety, and engagement. This trend indicates a potential for innovation in product offerings, as manufacturers may focus on creating toys that cater to the evolving needs of infants and toddlers. Consequently, the baby toys market is poised for growth as new parents invest in quality toys for their children.

Focus on Safety Standards

Safety remains a paramount concern in the baby toys market in Germany, influencing purchasing decisions among parents. Stringent regulations and safety standards are in place to ensure that toys are safe for infants and toddlers. The German market has seen an increase in demand for toys that comply with these safety regulations, which may include certifications such as EN71. This focus on safety not only reassures parents but also drives manufacturers to innovate and improve their product offerings. As awareness of safety issues grows, the baby toys market is likely to see a rise in demand for non-toxic, eco-friendly materials and designs that prioritize child safety. This trend may lead to a more competitive landscape as brands strive to meet the high expectations of safety-conscious consumers.

Growing E-commerce Adoption

The baby toys market in Germany is significantly influenced by the rapid adoption of e-commerce platforms. Recent data shows that online sales of baby products have surged, accounting for over 30% of total sales in the sector. This shift towards digital shopping is reshaping consumer behavior, as parents increasingly prefer the convenience of purchasing baby toys online. E-commerce allows for a wider selection of products, competitive pricing, and the ability to compare reviews and ratings. As a result, traditional brick-and-mortar stores are adapting to this trend by enhancing their online presence. The growth of e-commerce is likely to continue driving sales in the baby toys market, as more parents turn to online platforms for their purchasing needs.

Influence of Social Media Marketing

The baby toys market in Germany is increasingly shaped by the influence of social media marketing. Platforms such as Instagram and Facebook have become vital channels for brands to engage with parents and promote their products. Influencers and parenting bloggers play a crucial role in shaping consumer perceptions and driving trends within the market. Recent surveys indicate that over 60% of parents are influenced by social media when making purchasing decisions for baby toys. This trend suggests that brands must invest in digital marketing strategies to effectively reach their target audience. As social media continues to evolve, the baby toys market may witness a shift in how products are marketed, with an emphasis on visual content and user-generated reviews.

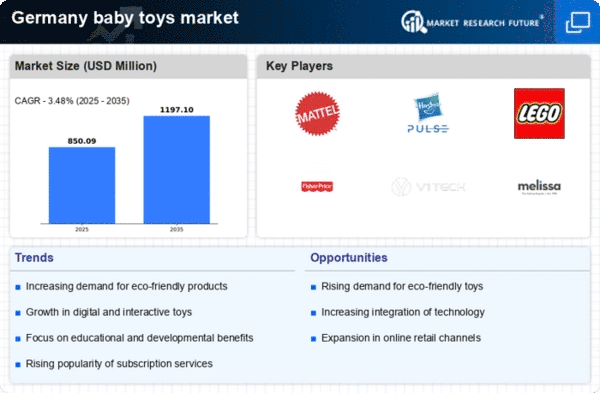

Rising Demand for Eco-Friendly Products

The baby toys market in Germany is witnessing a rising demand for eco-friendly products, reflecting a broader societal shift towards sustainability. Parents are increasingly concerned about the environmental impact of the toys they purchase for their children. This trend is prompting manufacturers to explore sustainable materials and production methods. Recent market analysis indicates that eco-friendly toys are projected to capture a growing share of the market, with estimates suggesting a potential increase of 20% in sales over the next five years. As consumers become more environmentally conscious, the baby toys market is likely to adapt by offering a wider range of sustainable options, thereby appealing to a demographic that prioritizes eco-friendliness in their purchasing decisions.