Sustainability Focus

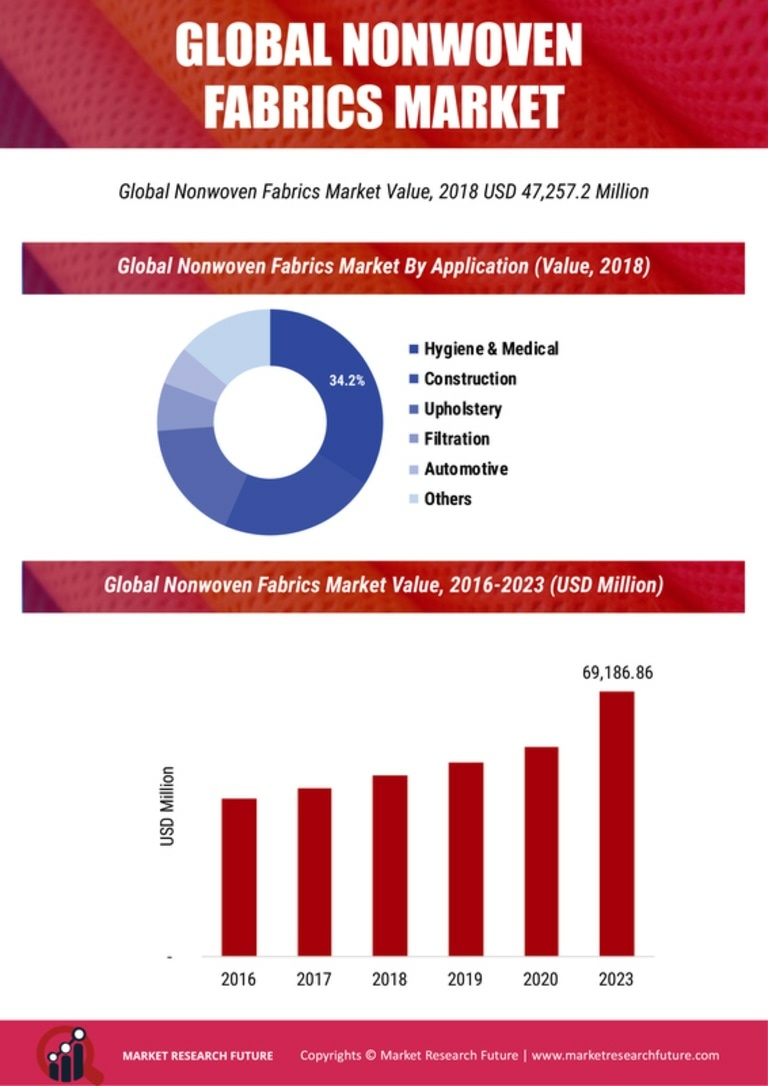

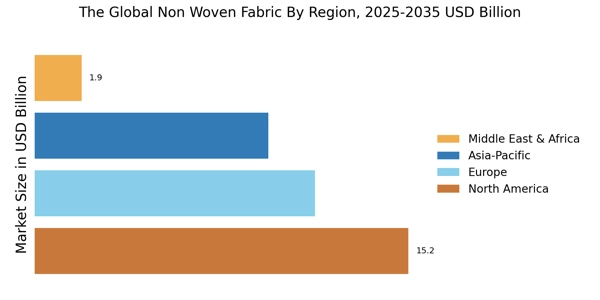

The increasing emphasis on sustainability is a pivotal driver for the Non Woven Fabric Market. As consumers and manufacturers alike become more environmentally conscious, the demand for eco-friendly materials is surging. Non woven fabrics, often made from recycled materials, align well with this trend. The market is projected to witness a compound annual growth rate (CAGR) of approximately 6% over the next few years, driven by the rising preference for biodegradable and recyclable products. This shift not only enhances the appeal of non woven fabrics in various applications, such as hygiene products and geotextiles, but also encourages innovation in production processes. Companies are likely to invest in sustainable practices, which could further bolster the market's growth. Thus, the sustainability focus appears to be a significant catalyst for the evolution of the Non Woven Fabric Market.

Hygiene Product Demand

The escalating demand for hygiene products is a crucial factor propelling the Non Woven Fabric Market. With the rising awareness of health and hygiene, particularly in personal care and medical sectors, non woven fabrics are increasingly utilized in products such as diapers, feminine hygiene products, and surgical masks. The market for hygiene products is expected to grow at a robust pace, with estimates suggesting a valuation exceeding USD 20 billion by 2026. This growth is likely to be fueled by the expanding population and the increasing disposable income in emerging economies. As manufacturers seek to enhance product performance and comfort, the versatility of non woven fabrics makes them an attractive choice. Consequently, the demand for hygiene products is anticipated to remain a driving force in the Non Woven Fabric Market.

Technological Advancements

Technological advancements are reshaping the landscape of the Non Woven Fabric Market. Innovations in manufacturing processes, such as spunbond and meltblown technologies, are enhancing the quality and functionality of non woven fabrics. These advancements enable the production of lightweight, durable, and cost-effective materials, which are increasingly sought after in various applications, including automotive, construction, and medical sectors. The market is projected to expand as companies adopt these technologies to improve efficiency and reduce production costs. Furthermore, the integration of automation and smart manufacturing techniques is likely to streamline operations, thereby increasing output and meeting the growing demand. As a result, technological advancements are expected to play a pivotal role in driving the Non Woven Fabric Market forward.

Growing Automotive Applications

The growing applications of non woven fabrics in the automotive sector represent a significant driver for the Non Woven Fabric Market. Non woven materials are increasingly utilized in automotive interiors, sound insulation, and filtration systems due to their lightweight and versatile properties. The automotive industry is undergoing a transformation towards more sustainable and efficient materials, with non woven fabrics being favored for their performance characteristics. The market for automotive non woven fabrics is anticipated to grow at a CAGR of around 5% in the coming years, driven by the rising demand for fuel-efficient vehicles and the need for enhanced comfort. As manufacturers continue to innovate and explore new applications, the automotive sector is likely to remain a key contributor to the expansion of the Non Woven Fabric Market.

Rising Demand in Construction Sector

The rising demand for non woven fabrics in the construction sector is emerging as a vital driver for the Non Woven Fabric Market. Non woven materials are increasingly employed in geotextiles, insulation, and roofing applications due to their durability and moisture resistance. The construction industry is experiencing growth, particularly in developing regions, where infrastructure projects are on the rise. This trend is expected to propel the demand for non woven fabrics, with the market projected to reach a valuation of USD 10 billion by 2027. As construction practices evolve towards more sustainable solutions, non woven fabrics are likely to gain traction for their eco-friendly properties. Consequently, the construction sector's rising demand is poised to significantly influence the trajectory of the Non Woven Fabric Market.