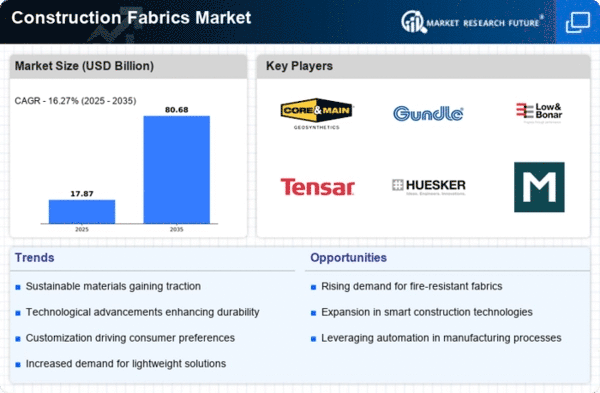

Market Growth Projections

The Global Construction Fabrics Market Industry is poised for substantial growth, with projections indicating a market size of 1.95 USD Billion in 2024 and an impressive increase to 7.25 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate of 12.69% from 2025 to 2035, driven by various factors including technological advancements, urbanization, and increased safety regulations. The market's expansion is indicative of the rising importance of construction fabrics in modern building practices, as they play a crucial role in enhancing structural integrity and sustainability. These projections highlight the dynamic nature of the industry and its potential for future development.

Increased Focus on Safety and Compliance

Safety regulations and compliance standards in the construction industry are becoming increasingly stringent, thereby driving the demand for specialized construction fabrics. The Global Construction Fabrics Market Industry is responding to this need by offering materials that meet or exceed safety standards, such as fire resistance and structural integrity. This heightened focus on safety not only protects workers but also enhances the longevity of structures. As a result, manufacturers are likely to invest in research and development to create fabrics that comply with evolving regulations. This trend is indicative of a broader commitment to safety within the industry, which is expected to support sustained growth in the Global Construction Fabrics Market.

Technological Advancements in Fabric Manufacturing

Technological innovations in fabric manufacturing are significantly influencing the Global Construction Fabrics Market Industry. Advanced production techniques, such as 3D weaving and smart textiles, enhance the performance and durability of construction fabrics. These innovations not only improve the quality of materials but also reduce production costs, making them more accessible to a broader range of construction projects. As the industry evolves, the integration of technology is likely to attract new investments and foster competitive advantages. This trend is expected to contribute to a compound annual growth rate of 12.69% from 2025 to 2035, reflecting the dynamic nature of the Global Construction Fabrics Market.

Growing Urbanization and Infrastructure Development

The rapid pace of urbanization and infrastructure development across the globe is a key driver for the Global Construction Fabrics Market Industry. As urban populations continue to swell, the demand for housing, transportation, and public facilities escalates, necessitating the use of high-performance construction fabrics. Governments and private sectors are investing heavily in infrastructure projects, which in turn fuels the need for durable and versatile materials. This trend is likely to sustain the market's growth trajectory, with projections indicating a rise to 1.95 USD Billion in 2024 and a potential increase to 7.25 USD Billion by 2035, underscoring the critical role of construction fabrics in modern development.

Rising Demand for Sustainable Construction Materials

The Global Construction Fabrics Market Industry is witnessing a notable shift towards sustainable construction materials, driven by increasing environmental awareness and regulatory pressures. As governments worldwide implement stricter building codes and sustainability initiatives, the demand for eco-friendly construction fabrics is expected to rise. This trend aligns with the projected market growth, with the industry anticipated to reach 1.95 USD Billion in 2024 and potentially expand to 7.25 USD Billion by 2035. The emphasis on reducing carbon footprints and enhancing energy efficiency in construction projects further propels the adoption of sustainable materials, indicating a robust future for the Global Construction Fabrics Market.

Expansion of the Construction Sector in Emerging Economies

Emerging economies are experiencing rapid growth in their construction sectors, which is significantly impacting the Global Construction Fabrics Market Industry. Countries in Asia-Pacific, Latin America, and Africa are investing in large-scale infrastructure projects, driven by urbanization and economic development. This expansion creates a substantial demand for construction fabrics that can withstand diverse environmental conditions. As these markets mature, the need for innovative and high-quality materials is likely to increase, presenting opportunities for manufacturers. The anticipated growth in these regions aligns with the overall market projections, suggesting a robust future for the Global Construction Fabrics Market.