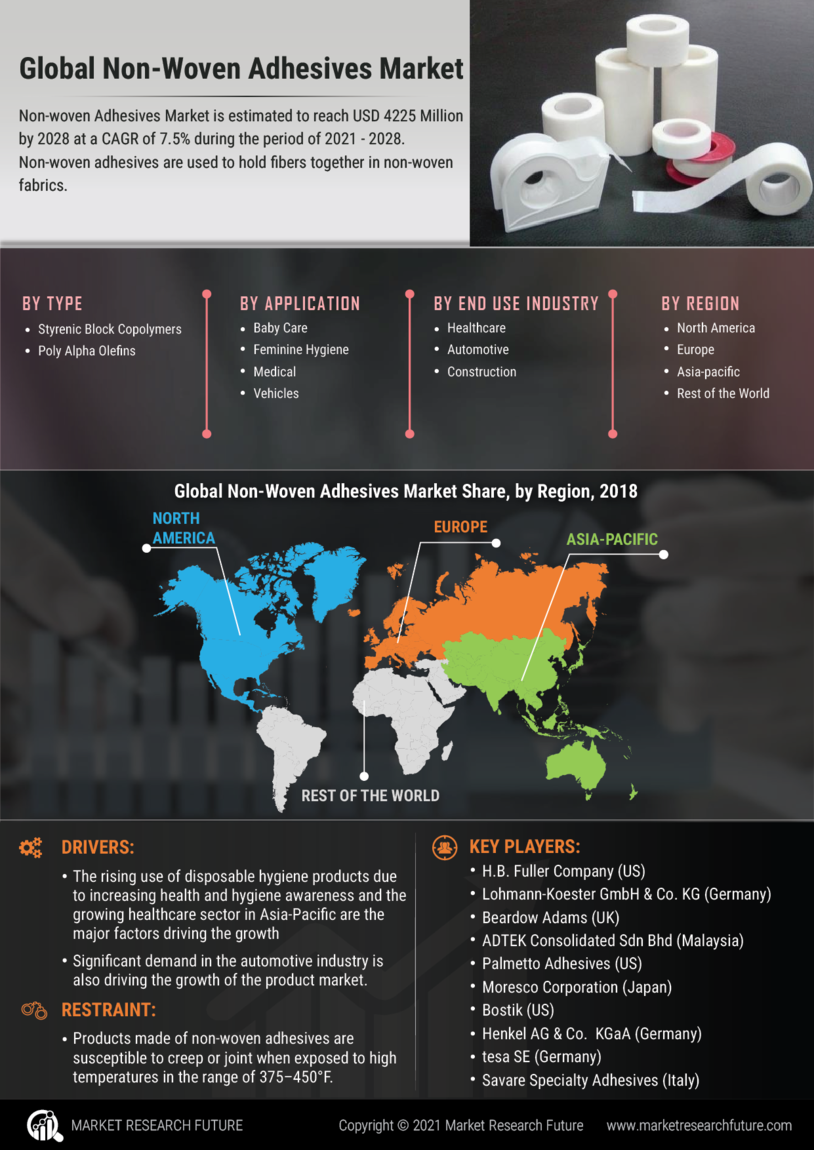

Market Growth Projections

The Global Non-Woven Adhesive Market Industry is projected to experience substantial growth over the coming years. With a market value expected to reach 5.15 USD Billion in 2024 and potentially 11.4 USD Billion by 2035, the industry is on a trajectory of robust expansion. The compound annual growth rate of 7.5% from 2025 to 2035 indicates a strong demand for non-woven adhesives across various sectors, including healthcare, automotive, and consumer products. This growth reflects the increasing reliance on non-woven adhesives for their versatility and performance.

Growth in Automotive Applications

The automotive sector is a significant driver for the Global Non-Woven Adhesive Market Industry, as manufacturers seek lightweight and durable materials to improve vehicle performance and fuel efficiency. Non-woven adhesives are employed in various applications, including interior trim, sound insulation, and bonding components. The increasing focus on sustainability and the use of eco-friendly materials further bolster this trend. As the automotive industry evolves, the demand for non-woven adhesives is expected to contribute to the market's growth, potentially reaching 11.4 USD Billion by 2035.

Rising Demand in Healthcare Sector

The Global Non-Woven Adhesive Market Industry is experiencing a notable surge in demand, particularly within the healthcare sector. Non-woven adhesives are increasingly utilized in medical applications such as surgical dressings, wound care, and hygiene products. This growth is driven by the need for advanced materials that offer superior adhesion and comfort. As the healthcare industry continues to expand, the market for non-woven adhesives is projected to reach 5.15 USD Billion in 2024, reflecting the critical role these materials play in enhancing patient care and safety.

Increasing Use in Consumer Products

The Global Non-Woven Adhesive Market Industry is significantly influenced by the rising use of non-woven adhesives in consumer products. These adhesives are commonly found in items such as diapers, feminine hygiene products, and household cleaning materials. The convenience and effectiveness of non-woven adhesives in these applications are driving their adoption among manufacturers. As consumer preferences shift towards products that offer enhanced performance and comfort, the demand for non-woven adhesives is expected to rise, further solidifying their position in the market.

Sustainability Trends in Manufacturing

Sustainability is becoming a pivotal factor in the Global Non-Woven Adhesive Market Industry. Manufacturers are increasingly adopting eco-friendly practices and materials, responding to consumer demand for sustainable products. Non-woven adhesives made from renewable resources are gaining traction, as they align with global efforts to reduce environmental impact. This trend not only enhances brand reputation but also meets regulatory requirements for sustainability. As a result, the market is poised for growth, with an increasing number of manufacturers prioritizing sustainable adhesive solutions.

Technological Advancements in Adhesive Formulations

Innovations in adhesive formulations are reshaping the Global Non-Woven Adhesive Market Industry. Manufacturers are investing in research and development to create high-performance adhesives that cater to diverse applications. These advancements include the development of bio-based adhesives and those with enhanced thermal stability and moisture resistance. Such innovations not only improve product performance but also align with the growing demand for sustainable solutions. As a result, the market is likely to witness a compound annual growth rate of 7.5% from 2025 to 2035, indicating a robust future driven by technological progress.