Research Methodology on Non-Woven Fabric Market

Introduction

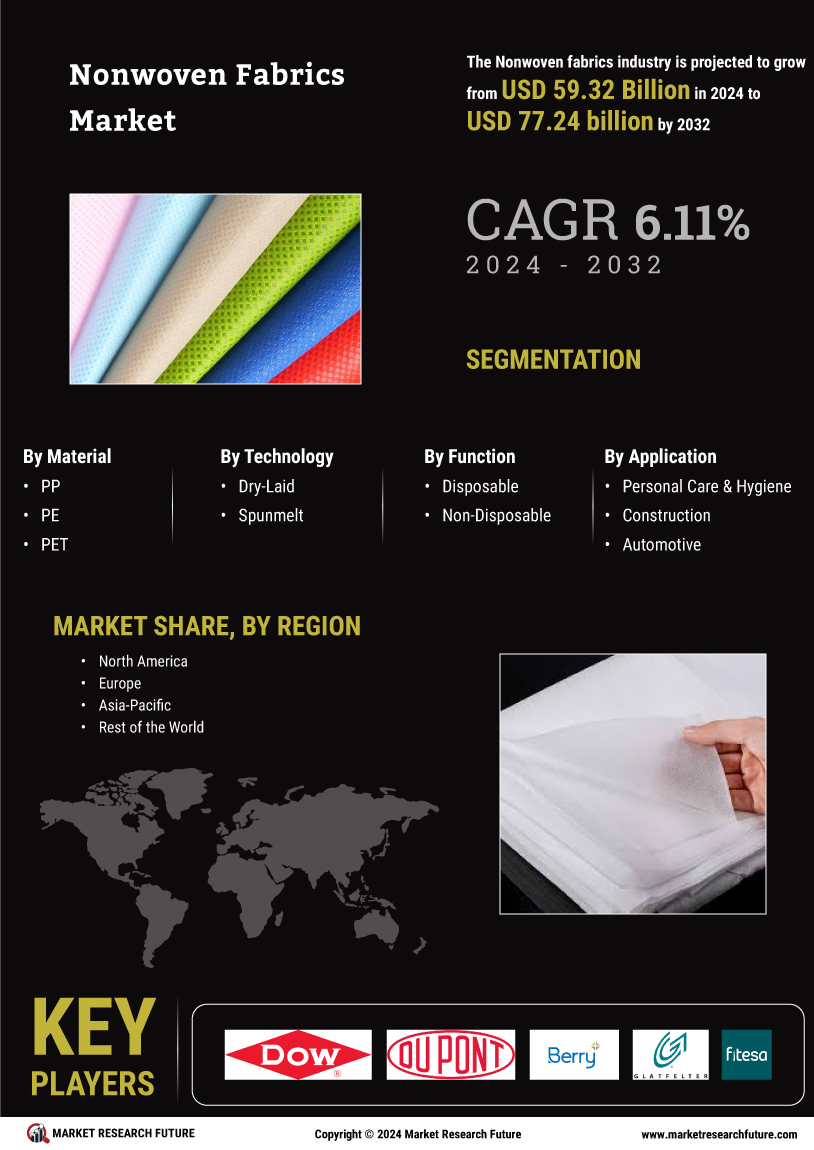

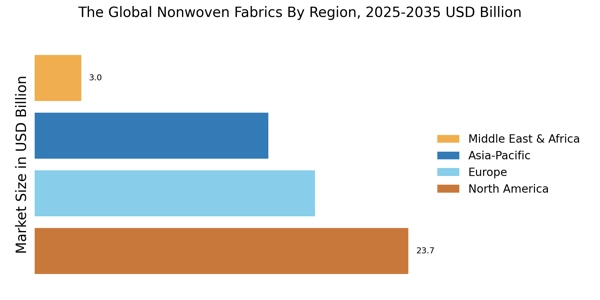

The Non-woven Fabric Market Report is a comprehensive document that sheds light on the fastest-growing industries in the world. Considerable efforts are made to provide a detailed analysis of the latest developments in this market. The report provides an overview of the various factors affecting the growth of the market and the various challenges it faces. The geographical and regional market outlook is also studied to provide insight into the regional dynamics of the industry.

Research Methodology

To analyse the market in-depth and gain insight into the various factors driving its growth, this report adopts a two-step research methodology. Primary research is conducted to collect qualitative as well as quantitative market insights that provide an idea of the current dynamics of the market. A range of sources such as industry experts, key opinion leaders and market analysts are consulted during the primary research process.

Secondary research is then carried out to validate the facts collected from primary research. Secondary data collected from authoritative and credible sources is used to gain an in-depth understanding of the market environment. These data sources include annual reports, published documents, regional and global economic indicators, industry journals, news articles and websites.

In order to further focus on the target market and generate comprehensive insights regarding market dynamics, data triangulation and market sizing using the top-down and bottom-up approaches are adopted. This is achieved by combining estimates from various primary and secondary sources. Further, the report incorporates market forecasting models ranging from average absolute error, and market share models to regression analysis.

In the Non-Woven Fabric Market Report, the market analysis is performed by conducting both primary and secondary research. Each market segment is studied thoroughly to gain an in-depth understanding of the market dynamics. The competitive landscape of the market is studied to identify key players in the industry. A comprehensive industry analysis is conducted to provide a comprehensive view of the Non-Woven Fabric Market.

Data Collection Tools

In-depth interviews, focus groups and market surveys are the main data collection tools employed in this report. Expert reviews and opinions are sought from market experts, industry journals and publications. Information obtained from the participants of the focus groups provided data on the current trends in the market and future market opportunities. Statistical tools such as factor analysis, correlation matrix and market capitalisation models are used to analyse the collected information.

Market Forecasting

Market forecasting models used in this report include market share models, market penetration models, average absolute error (AAE) models and regression analysis. The market size of the Non-Woven Fabric Market is projected using a base-year approach with market trending factors and regression analysis. The forecast also considers seasonal and market trends to predict the overall market size.

Data Validation & Limitations

The accuracy of the collected data is validated by cross-checking datasets from relevant sources. The assessment of the overall industry and market size is done multiple times to ensure accuracy.

Conclusion

This report provides an in-depth analysis of the Non-Woven Fabric Market from a variety of perspectives. The report employs a two-step research methodology and statistics-driven market sizing approach to project the overall size of the market. The forecast models used in this report are based on average absolute error and market share models aimed at providing an accurate picture of the market. This report reviews the competitive landscape of the industry and provides detailed information on the major players in this market.