Consumer Awareness and Education

The growing consumer awareness regarding the benefits of non-wood microcrystalline materials is influencing purchasing decisions, thereby driving the Non-Wood Microcrystalline Market. Educational campaigns and information dissemination about the advantages of these materials, such as their biodegradability and low environmental impact, are fostering a more informed consumer base. As consumers become more knowledgeable, they are more inclined to choose products that incorporate non-wood microcrystalline components. Market Research Future indicates that this trend is likely to continue, with an estimated increase in consumer preference for sustainable products by 25% over the next few years. This heightened awareness is expected to propel the Non-Wood Microcrystalline Market forward.

Innovations in Production Techniques

Technological advancements in production techniques are playing a crucial role in shaping the Non-Wood Microcrystalline Market. Innovations such as improved extraction methods and processing technologies have led to higher efficiency and lower production costs. For instance, the introduction of advanced filtration systems has enabled manufacturers to produce microcrystalline materials with enhanced purity and quality. Market analysis shows that these innovations have the potential to increase production capacity by up to 20%, thereby meeting the growing demand. As companies invest in research and development, the Non-Wood Microcrystalline Market is likely to witness a wave of new products that cater to diverse applications, further driving market growth.

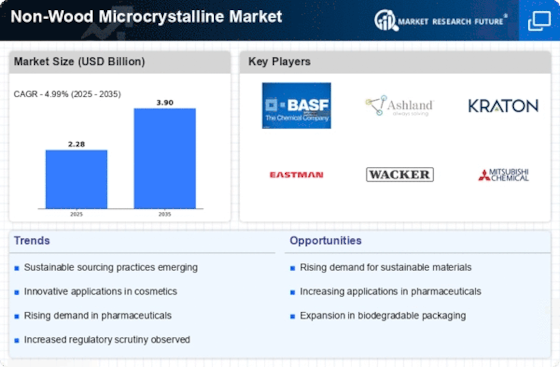

Rising Demand for Eco-Friendly Products

The increasing consumer preference for sustainable and eco-friendly products appears to be a significant driver in the Non-Wood Microcrystalline Market. As awareness of environmental issues grows, consumers are gravitating towards products that minimize ecological impact. This trend is reflected in the rising sales of non-wood microcrystalline materials, which are often derived from renewable sources. Market data indicates that the demand for such materials has surged by approximately 15% over the past year, suggesting a robust shift towards sustainability. Companies in the Non-Wood Microcrystalline Market are likely to benefit from this trend by aligning their product offerings with consumer values, potentially enhancing their market share and brand loyalty.

Expanding Applications Across Industries

The versatility of non-wood microcrystalline materials is contributing to their expanding applications across various industries, which serves as a key driver for the Non-Wood Microcrystalline Market. These materials are increasingly utilized in sectors such as pharmaceuticals, cosmetics, and food processing due to their unique properties. For example, in the pharmaceutical industry, non-wood microcrystalline cellulose is used as an excipient, enhancing drug formulation. Market data suggests that the pharmaceutical segment alone is projected to grow at a compound annual growth rate of 10% over the next five years. This diversification of applications is likely to bolster demand, positioning the Non-Wood Microcrystalline Market for sustained growth.

Regulatory Support for Sustainable Materials

Regulatory frameworks promoting the use of sustainable materials are emerging as a significant driver in the Non-Wood Microcrystalline Market. Governments are increasingly implementing policies that encourage the adoption of eco-friendly alternatives, which includes non-wood microcrystalline products. These regulations often provide incentives for manufacturers to shift towards sustainable practices, thereby enhancing market opportunities. For instance, certain regions have introduced tax benefits for companies that utilize renewable resources in their production processes. This regulatory support is likely to stimulate investment in the Non-Wood Microcrystalline Market, fostering innovation and expanding the market landscape.