Sustainability Initiatives

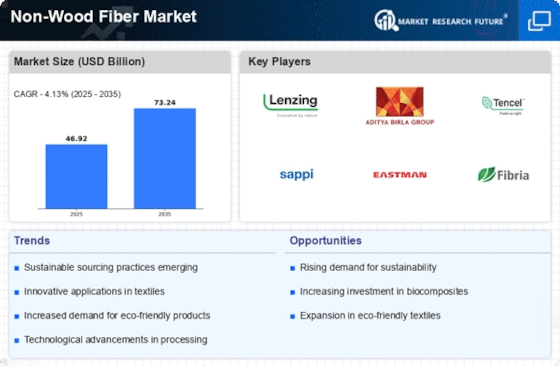

The increasing emphasis on sustainability appears to be a primary driver for the Non-Wood Fiber Market. As consumers and businesses alike become more environmentally conscious, the demand for sustainable materials rises. Non-wood fibers, such as hemp, jute, and flax, are often viewed as eco-friendly alternatives to traditional wood fibers. This shift is reflected in market data, which indicates that the non-wood fiber segment is projected to grow at a compound annual growth rate of approximately 8% over the next five years. Companies are increasingly investing in sustainable sourcing practices, which not only meet consumer demand but also align with corporate social responsibility goals. The Non-Wood Fiber Market is thus positioned to benefit from this trend, as more industries seek to reduce their carbon footprint and enhance their sustainability profiles.

Diversification of Applications

The diversification of applications for non-wood fibers is emerging as a key driver for the Non-Wood Fiber Market. Beyond traditional uses in textiles and paper, non-wood fibers are increasingly being utilized in construction, automotive, and biocomposite materials. This expansion into new sectors is indicative of the versatility and adaptability of non-wood fibers. For instance, the use of hemp fibers in biocomposites for automotive parts is gaining popularity due to their lightweight and strong properties. Market analysis suggests that the application of non-wood fibers in construction materials could grow by 15% over the next few years, as builders seek sustainable alternatives. This diversification not only broadens the market potential but also enhances the resilience of the Non-Wood Fiber Market against fluctuations in specific sectors.

Innovative Processing Techniques

Technological advancements in processing techniques are likely to play a crucial role in the Non-Wood Fiber Market. Innovations such as enzymatic treatments and advanced spinning technologies have the potential to enhance the quality and performance of non-wood fibers. For instance, the introduction of bio-based processing methods can lead to higher yield rates and lower energy consumption, making non-wood fibers more competitive against traditional materials. Market data suggests that the adoption of these technologies could increase production efficiency by up to 30%, thereby reducing costs and improving profitability for manufacturers. As these innovations continue to evolve, they may attract further investment into the Non-Wood Fiber Market, fostering growth and expanding applications across various sectors, including textiles, construction, and automotive.

Regulatory Support and Incentives

Government support and regulatory frameworks are increasingly influencing the Non-Wood Fiber Market. Many governments are implementing policies that promote the use of sustainable materials, including non-wood fibers, as part of broader environmental initiatives. Incentives such as tax breaks, grants, and subsidies for companies that utilize non-wood fibers can stimulate market growth. For example, recent legislation in several regions has mandated the use of sustainable materials in public procurement processes, thereby creating a steady demand for non-wood fibers. This regulatory environment not only encourages manufacturers to invest in non-wood fiber production but also enhances the overall market appeal. As a result, the Non-Wood Fiber Market is likely to experience accelerated growth driven by supportive government policies.

Rising Demand in Textile Applications

The textile industry is witnessing a notable shift towards non-wood fibers, which serves as a significant driver for the Non-Wood Fiber Market. With increasing consumer awareness regarding the environmental impact of conventional textiles, there is a growing preference for sustainable alternatives. Non-wood fibers, such as bamboo and organic cotton, are gaining traction due to their biodegradability and lower environmental footprint. Market data indicates that the demand for non-wood fiber textiles is expected to rise by approximately 10% annually, driven by both fashion trends and eco-conscious consumer behavior. This trend is further supported by brands that are actively seeking to enhance their sustainability credentials. Consequently, the Non-Wood Fiber Market is poised to capitalize on this rising demand, as more textile manufacturers incorporate non-wood fibers into their product lines.