Rising Environmental Awareness

The increasing awareness regarding environmental sustainability is driving the Non-phthalate Plasticizer Market. Consumers and manufacturers alike are becoming more conscious of the ecological impact of their choices. This shift is prompting a transition towards non-toxic alternatives, such as non-phthalate plasticizers, which are perceived as safer for both human health and the environment. As a result, the demand for these plasticizers is expected to rise, with market analysts projecting a compound annual growth rate of approximately 5% over the next few years. This trend indicates a significant opportunity for manufacturers to innovate and expand their product lines to meet the evolving preferences of environmentally conscious consumers.

Growing Demand in Emerging Markets

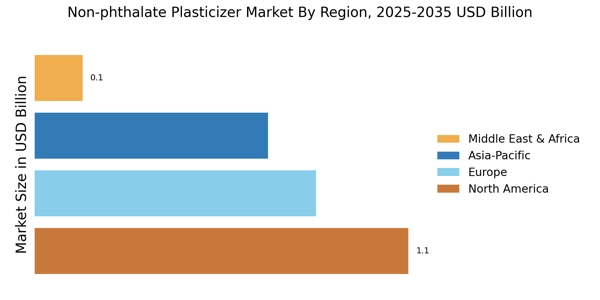

Emerging markets are exhibiting a growing demand for non-phthalate plasticizers, significantly impacting the Non-phthalate Plasticizer Market. As industrialization accelerates in these regions, there is an increasing need for safer and more sustainable materials in manufacturing processes. Countries in Asia and Latin America are particularly noteworthy, as they are experiencing rapid economic growth and urbanization. This trend is expected to drive the consumption of non-phthalate plasticizers, as industries seek to align with international safety standards and consumer preferences. Market projections indicate that the demand in these regions could increase by over 6% annually, presenting lucrative opportunities for manufacturers to expand their reach.

Regulatory Compliance and Standards

The Non-phthalate Plasticizer Market is significantly influenced by stringent regulations and standards imposed by various governmental bodies. These regulations aim to limit the use of harmful substances in consumer products, thereby promoting the adoption of safer alternatives. For instance, the European Union's REACH regulation has led to a marked increase in the demand for non-phthalate plasticizers, as manufacturers seek compliance to avoid penalties. This regulatory landscape not only drives innovation but also encourages companies to invest in research and development of non-phthalate solutions, thereby expanding the market. The ongoing evolution of these regulations suggests that the market will continue to grow as compliance becomes increasingly critical.

Technological Advancements in Production

Technological advancements in the production of non-phthalate plasticizers are playing a pivotal role in the Non-phthalate Plasticizer Market. Innovations in manufacturing processes have led to improved efficiency and cost-effectiveness, making these alternatives more accessible to a broader range of industries. For example, advancements in bio-based plasticizer technology have resulted in products that not only meet performance standards but also align with sustainability goals. As production techniques evolve, the market is likely to witness a surge in the availability of high-quality non-phthalate plasticizers, which could further stimulate demand across various applications, including automotive, construction, and consumer goods.

Consumer Preference for Healthier Alternatives

The shift in consumer preference towards healthier alternatives is a key driver of the Non-phthalate Plasticizer Market. As awareness of the potential health risks associated with phthalates grows, consumers are actively seeking products that are free from harmful chemicals. This trend is particularly evident in sectors such as food packaging, toys, and medical devices, where safety is paramount. Manufacturers are responding to this demand by reformulating products to include non-phthalate plasticizers, thereby enhancing their market appeal. The increasing consumer inclination towards safer products is likely to sustain the growth of the non-phthalate plasticizer market, with expectations of a steady rise in market share over the coming years.