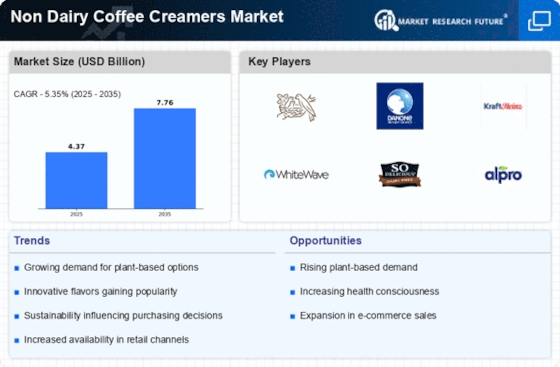

Health Consciousness

The increasing awareness of health and wellness among consumers appears to be a pivotal driver for the Non Dairy coffee Creamers Market. As individuals seek to reduce their intake of saturated fats and cholesterol, non-dairy alternatives are gaining traction. According to recent data, the demand for plant-based products has surged, with non-dairy creamers being a preferred choice for many. This shift is not merely a trend but reflects a broader lifestyle change towards healthier eating habits. The Non Dairy Coffee Creamers Market is likely to benefit from this growing health consciousness, as consumers opt for products that align with their dietary preferences and health goals. Furthermore, the rise in lactose intolerance and dairy allergies has prompted many to explore non-dairy options, further propelling market growth.

Sustainability Trends

Sustainability is emerging as a crucial driver for the Non Dairy Coffee Creamers Market, as consumers become more environmentally conscious. The demand for sustainable and ethically sourced ingredients is on the rise, prompting manufacturers to adopt eco-friendly practices. This includes sourcing raw materials from sustainable farms and utilizing recyclable packaging. Market Research Future suggests that consumers are increasingly inclined to support brands that prioritize sustainability, which could influence their purchasing decisions. As a result, companies that align their products with these values may gain a competitive edge in the Non Dairy Coffee Creamers Market. The emphasis on sustainability not only appeals to eco-conscious consumers but also reflects a broader societal shift towards responsible consumption.

Diverse Flavor Profiles

The Non Dairy Coffee Creamers Market is experiencing a notable expansion in flavor diversity, which seems to resonate well with consumers. Manufacturers are increasingly introducing a variety of flavors, ranging from classic vanilla and hazelnut to more exotic options like caramel and seasonal spices. This diversification caters to a wide range of consumer preferences, enhancing the appeal of non-dairy creamers. Market data indicates that flavored creamers are becoming a significant segment, with consumers willing to experiment with new tastes. This trend not only attracts new customers but also encourages brand loyalty as consumers seek unique flavor experiences. The ability to offer diverse flavor profiles positions the Non Dairy Coffee Creamers Market favorably in a competitive landscape, potentially leading to increased sales and market share.

Convenience and Accessibility

The convenience factor is a significant driver for the Non Dairy Coffee Creamers Market, as busy lifestyles lead consumers to seek quick and easy solutions for their coffee needs. Ready-to-use non-dairy creamers are increasingly available in various formats, including liquid, powdered, and single-serve options. This accessibility caters to a diverse consumer base, from busy professionals to families. Market data indicates that the rise of e-commerce has further enhanced the availability of these products, allowing consumers to purchase their preferred creamers with ease. The convenience of non-dairy creamers aligns well with the fast-paced nature of modern life, making them an attractive option for those looking to enhance their coffee experience without added hassle. This trend is likely to continue driving growth in the Non Dairy Coffee Creamers Market.

Innovative Product Development

Innovation in product development is a key driver for the Non Dairy Coffee Creamers Market, as companies strive to meet evolving consumer demands. The introduction of new formulations, such as creamers with added nutritional benefits or unique textures, is becoming increasingly common. This innovation not only attracts health-conscious consumers but also appeals to those seeking novel experiences. Market analysis indicates that products enriched with vitamins, minerals, or probiotics are gaining popularity, reflecting a shift towards functional food options. As manufacturers invest in research and development to create innovative non-dairy creamers, the Non Dairy Coffee Creamers Market is likely to witness sustained growth. This focus on innovation positions companies to capture a larger share of the market by addressing diverse consumer needs and preferences.