Environmental Regulations

The Nitrogen Fertilizer Additive Market is significantly influenced by environmental regulations aimed at reducing nitrogen runoff and promoting sustainable agricultural practices. Governments and regulatory bodies are implementing stricter guidelines to mitigate the environmental impact of fertilizers. For instance, regulations that limit nitrogen application rates are encouraging farmers to adopt nitrogen fertilizer additives that enhance efficiency and reduce waste. This shift not only aligns with environmental goals but also supports the economic viability of farming operations. As a result, the market for nitrogen fertilizer additives is expected to expand as farmers seek compliant solutions that optimize their fertilizer use while minimizing environmental harm. The emphasis on sustainable practices is likely to drive innovation within the Nitrogen Fertilizer Additive Market, leading to the development of more effective and eco-friendly products.

Technological Innovations

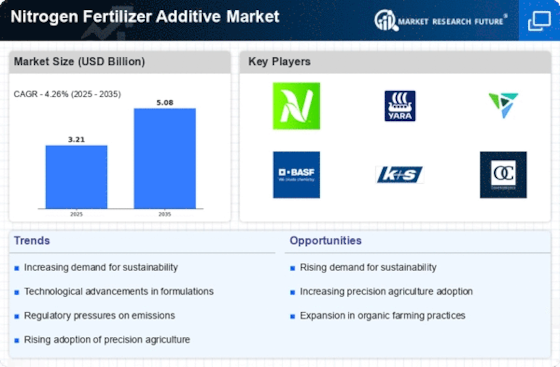

Technological advancements are playing a pivotal role in shaping the Nitrogen Fertilizer Additive Market. Innovations in fertilizer formulations and application techniques are enhancing the efficiency of nitrogen use in agriculture. For example, the development of slow-release nitrogen fertilizers and enhanced efficiency fertilizers (EEFs) is gaining traction among farmers. These products are designed to minimize nitrogen losses and improve crop uptake, thereby maximizing yield potential. The market for such innovative solutions is projected to witness substantial growth, as farmers increasingly recognize the benefits of adopting advanced nitrogen fertilizer additives. Furthermore, precision agriculture technologies, including soil sensors and data analytics, are enabling more targeted application of nitrogen fertilizers, which is likely to further propel the Nitrogen Fertilizer Additive Market. This trend indicates a shift towards more sustainable and efficient agricultural practices.

Rising Agricultural Demand

The increasing The Nitrogen Fertilizer Additive Industry. As agricultural practices intensify to meet these needs, the use of nitrogen fertilizers becomes crucial. According to recent data, the demand for nitrogen fertilizers is projected to grow at a compound annual growth rate of approximately 3.5% over the next few years. This growth is largely attributed to the need for higher crop yields and improved food security. Farmers are increasingly adopting nitrogen fertilizer additives to enhance soil fertility and crop productivity, thereby contributing to the overall growth of the Nitrogen Fertilizer Additive Market. The integration of these additives helps in optimizing nutrient uptake, which is essential for sustaining agricultural output in the face of rising demand.

Global Food Security Initiatives

Efforts to enhance The Nitrogen Fertilizer Additive Industry. Various initiatives aimed at increasing agricultural productivity and ensuring food availability are driving the demand for nitrogen fertilizers. Governments and organizations are investing in programs that promote the use of nitrogen fertilizer additives to boost crop yields and improve food quality. For instance, initiatives that focus on sustainable farming practices often include the use of nitrogen fertilizers as a key component. The emphasis on food security is likely to lead to increased funding and support for research and development in the Nitrogen Fertilizer Additive Market. As a result, the market is expected to expand as stakeholders recognize the critical role of nitrogen fertilizers in achieving food security goals and enhancing agricultural resilience.

Increasing Awareness of Soil Health

There is a growing awareness among farmers and agricultural stakeholders regarding the importance of soil health, which is significantly impacting the Nitrogen Fertilizer Additive Market. Healthy soil is essential for sustainable crop production, and nitrogen fertilizer additives are recognized for their role in enhancing soil fertility. As farmers seek to improve soil structure and nutrient availability, the demand for specialized nitrogen additives is likely to rise. Research indicates that the use of nitrogen fertilizers can lead to improved microbial activity and soil organic matter, which are critical for long-term agricultural sustainability. This heightened focus on soil health is expected to drive the adoption of nitrogen fertilizer additives, as they contribute to maintaining soil quality and enhancing crop resilience. Consequently, the Nitrogen Fertilizer Additive Market is poised for growth as more stakeholders prioritize soil health in their agricultural practices.