Nitrogen Trifluoride Market Summary

As per MRFR analysis, the Nitrogen Trifluoride Market Size was estimated at 8.83 USD Billion in 2024. The Nitrogen Trifluoride industry is projected to grow from 10.59 USD Billion in 2025 to 64.98 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 19.9 during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Nitrogen Trifluoride Market is poised for substantial growth driven by technological advancements and increasing demand across various sectors.

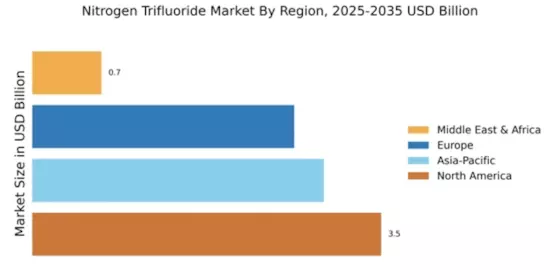

- North America remains the largest market for Nitrogen Trifluoride, primarily due to its robust electronics manufacturing sector.

- Asia-Pacific is recognized as the fastest-growing region, fueled by rapid advancements in semiconductor fabrication facilities.

- The Semiconductor Manufacturing segment holds the largest share, while the Flat Panel Display Production segment is experiencing the fastest growth.

- Key market drivers include the increasing demand in electronics manufacturing and the expansion of semiconductor fabrication facilities.

Market Size & Forecast

| 2024 Market Size | 8.83 (USD Billion) |

| 2035 Market Size | 64.98 (USD Billion) |

| CAGR (2025 - 2035) | 19.9% |

Major Players

Air Products and Chemicals (US), Linde plc (IE), Mitsubishi Gas Chemical Company (JP), Kanto Chemical Co., Inc. (JP), Taiyo Nippon Sanso Corporation (JP), Solvay S.A. (BE), Honeywell International Inc. (US), Showa Denko K.K. (JP)