Market Trends

Key Emerging Trends in the Nisin Market

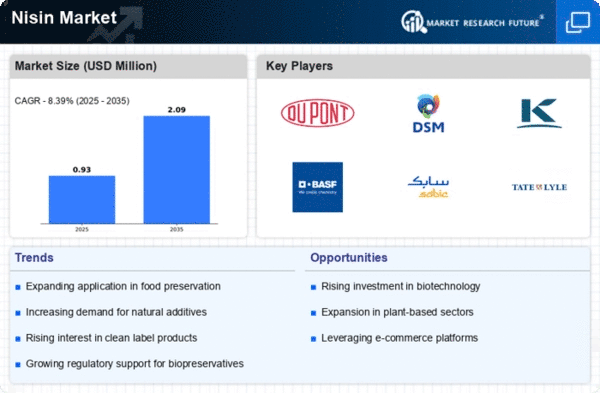

The Nisin market has been experiencing notable trends in recent times, reflecting the dynamic nature of the food industry. Nisin, a natural antimicrobial agent derived from the lactic acid bacteria, has gained significant traction in various food applications. Firstly, among the replacements market says the increasing population for without chemical additives and several chemical-free preservatives are. With heightened level of health awareness among consumers who prefer unadultered products, this sector has reached at a level whereby use of preservatives like Nisin is becoming a norm. The simplified labels are called out because they are connected with the global trend that is now too visible to consumers who demand cleaner and more transparent food labels, and they prefer to have more basic and natural ingredients.

Besides, a profound breakthrough in Nisin market is its progress in the domestic scale of dairy industry on the worldwide basis. While the surge of dairy products’ demand, producers are actively seeking not conventional strategies that prolong the shelf life of these short-lived commodities. Among various existing preservation methods, nisin, which is widely known for its efficiency in coping with spoilage and pathogenic bacteria, is favored by many in keeping dairy products fresh. This trend is especially visible in the production of cheese and yogurt problems arising from distribution and storage to preserve the quality of the product of is very crucial.

The fact that the increasing popularity of foodborne diseases has spurred food safety will hence result in the market adoption of Nisin. Under the strict regime of regulators, manufacturers must get their stuff together and pursue a preservation method that can pass the required tests. The antimicrobial nature of nisin is indeed a priceless asset in restraining the growth of dangerous bacteria, thereby elevating the quality of food and without any struggle to meet the demanded regulatory bodies. Data shows that this trend is not limited to developed nations only but is also growing day by day in the newly established economies where food safety issues are increasingly becoming more and more worried about.

Besides, the nisin market has growing trends in product and formulation innovation due to research and development. Nisin researchers and food technologists keep on their work to improve nisin's stability in different matrices which food is made of. This is attributed to the fact that there is a necessity for variations of the preservatives that are multifunctional and can also work well for different kinds of foods such that the sensory and nutritional attributes are not compromised the technological improvements in Nisin formulations, which is a novel research field, is foreseen that it would open up the way to its implementation in broad range of food and beverage segments.

Furthermore, Nisin is doing more than just being a food preservative, the expansion of industries' use is a valuable contribution to the market diversification. Its antibacterial effect has resulted in the utilization of it as an active ingredient in drugs and personal care items. The potential antimicrobial applications of Nisin in these industries are being explored, creating new opportunities for market players.

Leave a Comment