Market Growth Projections

The Global NIR and Raman Spectroscopy Market Industry is projected to experience robust growth over the coming years. With a market value of 1.47 USD Billion in 2024, it is anticipated to reach 5.48 USD Billion by 2035. This growth trajectory indicates a compound annual growth rate of 12.71% from 2025 to 2035. Factors such as technological advancements, increasing applications across various industries, and rising demand for quality control and safety measures are likely to contribute to this positive outlook.

Technological Advancements

The Global NIR and Raman Spectroscopy Market Industry is witnessing rapid technological advancements that enhance the capabilities and applications of these spectroscopic techniques. Innovations in detector technology, miniaturization of instruments, and the integration of artificial intelligence are driving the market forward. For instance, portable Raman spectrometers are now capable of providing real-time analysis in various fields, including pharmaceuticals and food safety. These advancements not only improve the accuracy and speed of analyses but also expand the potential user base, thereby contributing to the projected market growth from 1.47 USD Billion in 2024 to 5.48 USD Billion by 2035.

Expansion in Emerging Markets

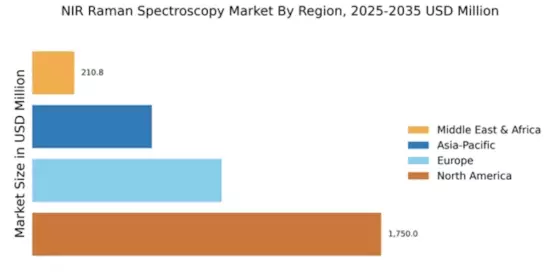

Emerging markets are becoming increasingly important for the Global NIR and Raman Spectroscopy Market Industry. Countries in Asia-Pacific and Latin America are experiencing rapid industrialization and urbanization, leading to a growing need for advanced analytical techniques. The expansion of industries such as agriculture, pharmaceuticals, and environmental monitoring in these regions is likely to drive demand for NIR and Raman spectroscopy. As these markets develop, they present significant opportunities for growth, contributing to the overall market expansion projected to reach 5.48 USD Billion by 2035.

Growing Demand in Pharmaceuticals

The pharmaceutical sector is a major driver for the Global NIR and Raman Spectroscopy Market Industry, as these techniques are essential for quality control and drug formulation. The increasing emphasis on stringent regulatory requirements necessitates the adoption of advanced analytical techniques. Raman spectroscopy, for example, is utilized for polymorph characterization and to ensure the consistency of drug products. As the pharmaceutical industry continues to expand, the demand for reliable and efficient analytical methods is expected to rise, contributing to a compound annual growth rate of 12.71% from 2025 to 2035.

Rising Applications in Food Safety

Food safety is becoming increasingly critical, and the Global NIR and Raman Spectroscopy Market Industry is poised to benefit from this trend. These spectroscopic techniques are employed for rapid and non-destructive analysis of food products, ensuring compliance with safety standards. For example, NIR spectroscopy is widely used for determining moisture content and detecting adulteration in food items. As consumers become more health-conscious and regulatory bodies enforce stricter safety measures, the demand for these analytical tools is likely to surge, further driving market growth.

Increasing Adoption in Environmental Monitoring

Environmental monitoring is an emerging application area for the Global NIR and Raman Spectroscopy Market Industry. These techniques are utilized for analyzing pollutants and assessing environmental quality. For instance, Raman spectroscopy can identify hazardous substances in water and air samples, providing critical data for regulatory compliance. As governments worldwide intensify their focus on environmental protection and sustainability, the demand for effective monitoring solutions is expected to rise. This trend may lead to increased investments in spectroscopic technologies, thereby enhancing market growth.