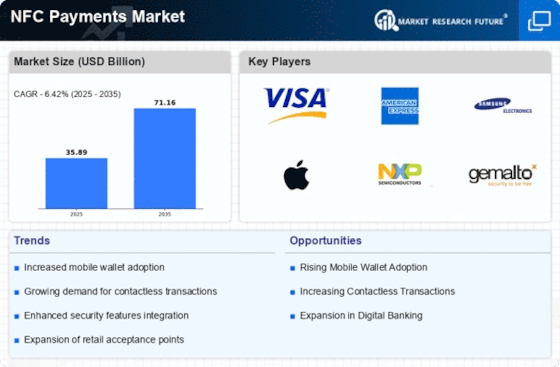

Growing Adoption of Mobile Wallets

The increasing adoption of mobile wallets is a pivotal driver for the NFC Payments Market. As consumers become more accustomed to using their smartphones for transactions, the demand for seamless payment solutions rises. In 2025, it is estimated that mobile wallet transactions will account for a substantial portion of the overall payment landscape, with projections indicating a growth rate of approximately 20% annually. This trend reflects a shift in consumer behavior towards convenience and efficiency, thereby propelling the NFC Payments Market forward. Retailers and service providers are increasingly integrating mobile wallet capabilities, enhancing customer experiences and driving further adoption. The proliferation of mobile wallets is likely to continue influencing the market dynamics, as consumers seek faster and more secure payment options.

Expansion of Retail and E-commerce Sectors

The expansion of retail and e-commerce sectors serves as a significant catalyst for the NFC Payments Market. As businesses increasingly embrace digital transformation, the integration of NFC technology into point-of-sale systems becomes more prevalent. In 2025, the retail sector is projected to witness a notable increase in NFC-enabled transactions, with estimates suggesting that over 50% of in-store payments may utilize NFC technology. This shift not only enhances the shopping experience but also streamlines operations for retailers. E-commerce platforms are also adopting NFC solutions to facilitate contactless payments, thereby catering to the evolving preferences of consumers. The convergence of retail and technology is likely to further stimulate growth in the NFC Payments Market, as businesses seek to remain competitive in an increasingly digital marketplace.

Technological Advancements in NFC Solutions

Technological advancements in NFC solutions are a driving force behind the NFC Payments Market. Innovations in hardware and software are enhancing the functionality and security of NFC transactions. In 2025, advancements such as improved encryption methods and biometric authentication are expected to bolster consumer trust in contactless payments. The introduction of new NFC-enabled devices, including wearables and IoT devices, is likely to expand the market further. As technology evolves, the integration of NFC capabilities into various platforms will become more seamless, facilitating a broader range of applications. This continuous evolution of technology is poised to create new opportunities within the NFC Payments Market, as businesses and consumers alike seek to leverage the benefits of enhanced payment solutions.

Rising Consumer Awareness of Security Features

Rising consumer awareness of security features associated with NFC payments is a crucial driver for the NFC Payments Market. As consumers become more informed about the security measures in place, their willingness to adopt contactless payment methods increases. In 2025, it is projected that consumer confidence in NFC technology will grow, driven by advancements in security protocols and the implementation of fraud detection systems. This heightened awareness is likely to lead to a surge in NFC transactions, as consumers prioritize secure payment options. Retailers and service providers are responding to this trend by emphasizing the security features of their NFC solutions, thereby enhancing consumer trust. The interplay between consumer awareness and technological advancements is expected to significantly influence the growth of the NFC Payments Market.

Government Initiatives Promoting Digital Payments

Government initiatives aimed at promoting digital payments are instrumental in driving the NFC Payments Market. Various countries are implementing policies to encourage cashless transactions, thereby fostering an environment conducive to the adoption of NFC technology. In 2025, it is anticipated that several governments will introduce incentives for businesses and consumers to utilize contactless payment methods. These initiatives may include tax benefits, subsidies for NFC infrastructure, and public awareness campaigns highlighting the advantages of digital payments. Such measures are likely to enhance consumer confidence in NFC transactions, leading to increased usage. The proactive stance of governments in promoting digital payment ecosystems is expected to significantly impact the growth trajectory of the NFC Payments Market.