Market Growth Projections

The Global MLCC for 5G Smartphones Market Industry is poised for substantial growth, with projections indicating a market size of 43.8 USD Billion by 2035. This growth trajectory is underpinned by various factors, including technological advancements, increasing smartphone penetration, and regulatory support for 5G deployment. The anticipated CAGR of 10.99% from 2025 to 2035 reflects the industry's potential to adapt and thrive in a rapidly evolving technological landscape. As demand for 5G smartphones continues to escalate, the MLCC market is likely to expand, driven by the need for high-performance components that support the functionality and efficiency of these devices.

Growing Smartphone Penetration

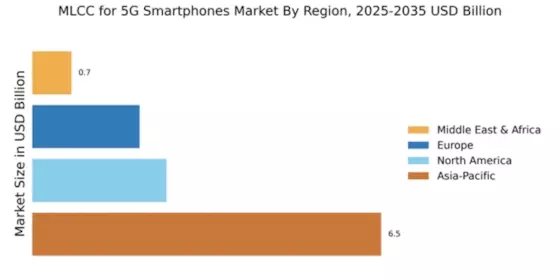

The Global MLCC for 5G Smartphones Market Industry is significantly impacted by the increasing penetration of smartphones worldwide. As more consumers transition to smartphones, particularly in emerging markets, the demand for 5G-enabled devices rises correspondingly. This trend is particularly evident in regions such as Asia-Pacific, where smartphone adoption is accelerating rapidly. The anticipated growth in the smartphone market is expected to contribute to the overall expansion of the MLCC market, with projections indicating a market size of 43.8 USD Billion by 2035. This growth underscores the importance of MLCCs in supporting the functionality and performance of next-generation smartphones.

Rising Demand for 5G Technology

The Global MLCC for 5G Smartphones Market Industry experiences a surge in demand driven by the rapid adoption of 5G technology. As consumers increasingly seek faster internet speeds and enhanced connectivity, smartphone manufacturers are compelled to integrate advanced components, including multilayer ceramic capacitors (MLCCs). The market is projected to reach 13.9 USD Billion in 2024, reflecting the growing need for efficient power management and signal integrity in 5G devices. This trend is likely to continue, as the global shift towards 5G networks fosters innovation and competition among smartphone manufacturers, thereby elevating the demand for high-performance MLCCs.

Technological Advancements in MLCCs

Innovations in MLCC technology significantly influence the Global MLCC for 5G Smartphones Market Industry. Manufacturers are focusing on enhancing the performance and miniaturization of MLCCs to meet the stringent requirements of 5G smartphones. These advancements include the development of high-capacitance MLCCs that can support the increased power demands of 5G applications. As a result, the market is expected to grow at a CAGR of 10.99% from 2025 to 2035, indicating a robust trajectory fueled by ongoing research and development efforts. This technological evolution not only improves device performance but also enables manufacturers to offer more compact and efficient designs.

Increased Focus on Energy Efficiency

The Global MLCC for 5G Smartphones Market Industry is also influenced by the heightened focus on energy efficiency among consumers and manufacturers alike. As environmental concerns gain prominence, there is a growing demand for smartphones that minimize energy consumption while maximizing performance. MLCCs play a pivotal role in achieving these objectives by enabling efficient power management and reducing energy waste in 5G devices. This trend aligns with global sustainability goals and is likely to drive innovation in MLCC design and application. As manufacturers strive to create energy-efficient smartphones, the demand for advanced MLCCs is expected to rise, further propelling market growth.

Regulatory Support for 5G Deployment

Government initiatives and regulatory support for 5G deployment play a crucial role in shaping the Global MLCC for 5G Smartphones Market Industry. Many countries are investing heavily in 5G infrastructure, which in turn drives the demand for 5G smartphones equipped with advanced MLCCs. Regulatory bodies are facilitating the rollout of 5G networks, creating an environment conducive to innovation and investment in related technologies. This supportive framework is likely to enhance the market dynamics, as manufacturers respond to the growing need for compliant and efficient components in their devices. Consequently, this trend is expected to bolster the demand for MLCCs in the coming years.