Rising Cybersecurity Concerns

Rising cybersecurity concerns are becoming a crucial driver in the Next Generation Computing Market. As digital transformation accelerates, organizations face heightened risks of cyber threats and data breaches. This has led to an increased focus on developing robust cybersecurity measures that can protect sensitive information and maintain operational integrity. The cybersecurity market is projected to exceed 300 billion dollars by 2024, underscoring the urgency for advanced security solutions. In response, the Next Generation Computing Market is likely to see the integration of advanced security protocols and technologies, such as AI-driven threat detection and blockchain-based security frameworks. This emphasis on cybersecurity is essential for fostering trust and ensuring the safe adoption of next-generation computing technologies.

Emergence of Quantum Computing

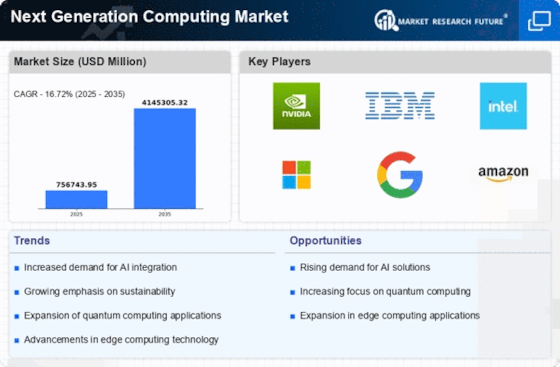

The Next Generation Computing Market is on the brink of a transformative shift with the emergence of quantum computing. This technology promises to revolutionize problem-solving capabilities, particularly in fields such as cryptography, materials science, and complex system modeling. Quantum computers leverage the principles of quantum mechanics to perform calculations at unprecedented speeds, potentially solving problems that are currently intractable for classical computers. As investments in quantum research and development continue to rise, the market is expected to witness substantial growth. Industry analysts suggest that the quantum computing market could reach 10 billion dollars by 2027, reflecting the increasing interest and potential applications of this groundbreaking technology. The integration of quantum computing into existing infrastructures may redefine the competitive landscape within the Next Generation Computing Market.

Expansion of Edge Computing Solutions

The expansion of edge computing solutions is significantly influencing the Next Generation Computing Market. As the Internet of Things (IoT) continues to proliferate, the need for processing data closer to the source has become increasingly apparent. Edge computing reduces latency and bandwidth usage, enabling real-time data processing and analysis. This shift is particularly relevant in sectors such as manufacturing, healthcare, and smart cities, where timely data insights are critical. The edge computing market is anticipated to grow to approximately 15 billion dollars by 2025, reflecting the increasing reliance on decentralized computing architectures. This trend is likely to drive innovation within the Next Generation Computing Market, as companies seek to develop more efficient and responsive computing solutions.

Increased Demand for High-Performance Computing

The Next Generation Computing Market is experiencing a surge in demand for high-performance computing (HPC) solutions. This demand is driven by the need for advanced data processing capabilities across various sectors, including finance, healthcare, and scientific research. As organizations increasingly rely on data analytics and simulations, the market for HPC is projected to grow significantly. According to recent estimates, the HPC market is expected to reach a valuation of over 50 billion dollars by 2026. This growth is indicative of the broader trend towards more powerful computing solutions that can handle complex tasks efficiently. Consequently, the Next Generation Computing Market is likely to see a proliferation of HPC technologies, which may include enhanced processors, memory architectures, and software solutions designed to optimize performance.

Artificial Intelligence and Machine Learning Integration

The integration of artificial intelligence (AI) and machine learning (ML) technologies is a pivotal driver in the Next Generation Computing Market. Organizations are increasingly adopting AI and ML to enhance operational efficiency, improve decision-making, and drive innovation. The market for AI in computing is projected to grow at a compound annual growth rate (CAGR) of over 40%, indicating a robust demand for intelligent computing solutions. This integration allows for the development of smarter applications that can learn from data and adapt to changing conditions. As AI and ML continue to evolve, they are likely to play a crucial role in shaping the future of the Next Generation Computing Market, leading to the creation of more sophisticated and autonomous systems.