Shift to Remote Work Models

The Cloud Workload Protection Market is benefiting from the ongoing shift towards remote work models. As organizations increasingly adopt flexible work arrangements, the reliance on cloud services has intensified. This transition necessitates enhanced security measures to protect sensitive data and workloads accessed remotely. In 2025, it is projected that over 70% of organizations will have adopted a hybrid work model, further amplifying the demand for cloud workload protection solutions. Consequently, businesses are prioritizing investments in security technologies that can ensure the integrity and confidentiality of their cloud environments. This trend underscores the critical role of the Cloud Workload Protection Market in facilitating secure remote operations.

Rising Cybersecurity Threats

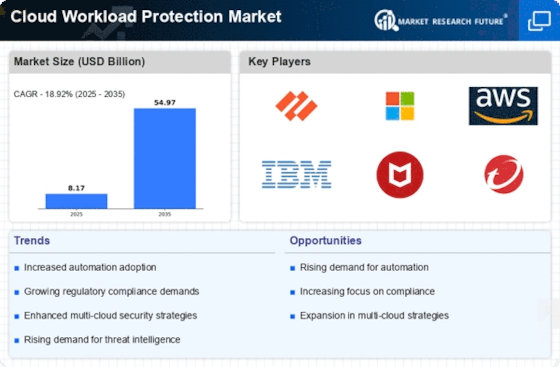

The Cloud Workload Protection Market is experiencing a surge in demand due to the increasing frequency and sophistication of cyber threats. Organizations are recognizing the necessity of robust security measures to safeguard their cloud workloads. In 2025, it is estimated that cybercrime will cost businesses over 10 trillion dollars annually, prompting companies to invest heavily in cloud workload protection solutions. This trend indicates a growing awareness of the vulnerabilities associated with cloud environments, leading to a heightened focus on security solutions that can effectively mitigate risks. As a result, the Cloud Workload Protection Market is likely to expand significantly, driven by the urgent need for comprehensive security frameworks that can adapt to evolving threats.

Regulatory Compliance Pressures

The Cloud Workload Protection Market is significantly influenced by the increasing regulatory compliance pressures faced by organizations. With the introduction of stringent data protection regulations, such as GDPR and CCPA, businesses are compelled to implement robust security measures to avoid hefty fines and reputational damage. In 2025, it is anticipated that compliance-related expenditures will reach approximately 20 billion dollars, highlighting the financial implications of non-compliance. This environment creates a fertile ground for the Cloud Workload Protection Market, as organizations seek solutions that not only protect their workloads but also ensure adherence to regulatory requirements. The intersection of compliance and security is likely to drive innovation and investment in this sector.

Growing Demand for Cloud Migration

The Cloud Workload Protection Market is poised for growth as organizations increasingly migrate their operations to the cloud. This trend is driven by the need for scalability, flexibility, and cost-efficiency. In 2025, it is expected that cloud adoption will reach 90% among enterprises, necessitating the implementation of effective workload protection strategies. As businesses transition to cloud environments, they face new security challenges that require specialized solutions. The demand for cloud workload protection is likely to rise in tandem with this migration, as organizations seek to safeguard their data and applications in the cloud. This dynamic presents a significant opportunity for the Cloud Workload Protection Market to expand its offerings and address the evolving needs of businesses.

Integration of Advanced Technologies

The Cloud Workload Protection Market is witnessing a transformative phase with the integration of advanced technologies such as artificial intelligence and machine learning. These technologies enhance the capabilities of cloud workload protection solutions, enabling organizations to proactively identify and respond to threats. In 2025, it is projected that the market for AI-driven security solutions will surpass 30 billion dollars, reflecting the growing recognition of the importance of intelligent security measures. As organizations seek to leverage these technologies, the Cloud Workload Protection Market is likely to experience increased investment and innovation. This trend suggests a shift towards more sophisticated security frameworks that can adapt to the complexities of modern cloud environments.