Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure and funding for neurological research are significant drivers of the neurology devices market. The UK government has been actively investing in healthcare innovation, with a focus on enhancing the quality of care for patients with neurological disorders. Initiatives such as the National Health Service (NHS) Long Term Plan emphasize the importance of early diagnosis and treatment, which in turn boosts the demand for advanced neurology devices. Additionally, funding programs for research and development in neurology are encouraging companies to innovate and bring new devices to market. This supportive environment is likely to foster collaboration between public and private sectors, ultimately benefiting the neurology devices market by ensuring that cutting-edge technologies are accessible to healthcare providers and patients alike.

Rising Awareness and Patient Advocacy

Rising awareness of neurological disorders and the importance of early diagnosis is significantly impacting the neurology devices market. Patient advocacy groups are playing a pivotal role in educating the public about various neurological conditions, thereby increasing the demand for diagnostic and therapeutic devices. Campaigns aimed at reducing stigma and promoting understanding of disorders such as epilepsy and dementia are encouraging individuals to seek medical attention sooner. This heightened awareness is likely to lead to an increase in diagnoses, which in turn drives the need for effective neurology devices. Furthermore, as patients become more informed about their treatment options, they may actively seek out advanced devices, thereby influencing market dynamics. The growing emphasis on patient-centered care is expected to further propel the neurology devices market in the UK.

Rising Prevalence of Neurological Disorders

The increasing incidence of neurological disorders in the UK is a primary driver of the neurology devices market. Conditions such as Alzheimer's disease, Parkinson's disease, and multiple sclerosis are becoming more prevalent, affecting a significant portion of the population. According to recent estimates, approximately 1 in 6 people in the UK are diagnosed with a neurological condition, which translates to millions of individuals requiring medical intervention. This growing patient base necessitates the development and adoption of advanced neurology devices, as healthcare providers seek effective solutions for diagnosis and treatment. The demand for innovative devices, such as neurostimulation systems and diagnostic imaging tools, is likely to rise, thereby propelling market growth. As the population ages, the burden of neurological disorders is expected to increase, further driving the need for effective neurology devices in the UK.

Technological Innovations in Device Development

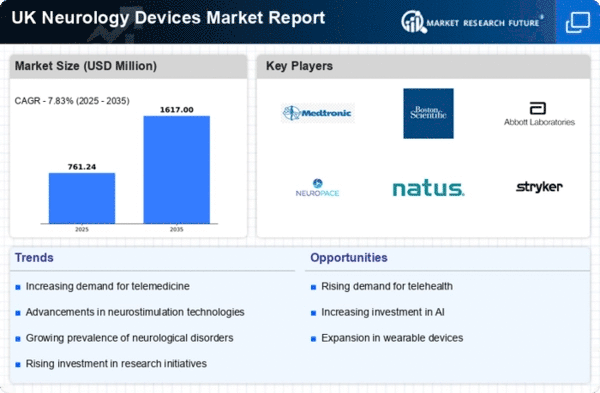

Technological advancements play a crucial role in shaping the neurology devices market. Innovations in areas such as neuroimaging, neurostimulation, and wearable devices are enhancing the capabilities of neurology devices. For instance, the integration of artificial intelligence (AI) and machine learning in diagnostic tools is improving accuracy and efficiency in identifying neurological conditions. The market is witnessing a surge in the development of minimally invasive devices, which offer patients reduced recovery times and improved outcomes. Furthermore, the introduction of telemedicine solutions is facilitating remote monitoring and management of neurological disorders, expanding access to care. As these technologies continue to evolve, they are likely to attract investment and drive growth in the neurology devices market, catering to the needs of both healthcare providers and patients in the UK.

Aging Population and Increased Healthcare Expenditure

The aging population in the UK critically influences the neurology devices market. As individuals age, the likelihood of developing neurological disorders increases, leading to a higher demand for medical devices tailored to this demographic. The Office for National Statistics projects that by 2040, the number of people aged 65 and over will rise significantly, creating a pressing need for effective neurological care. Concurrently, increased healthcare expenditure by both the government and private sectors is facilitating the adoption of advanced neurology devices. This financial commitment is likely to support the development of innovative solutions that address the unique challenges posed by an aging population. Consequently, the intersection of demographic trends and healthcare investment is expected to drive substantial growth in the neurology devices market.