North America : Innovation and Leadership Hub

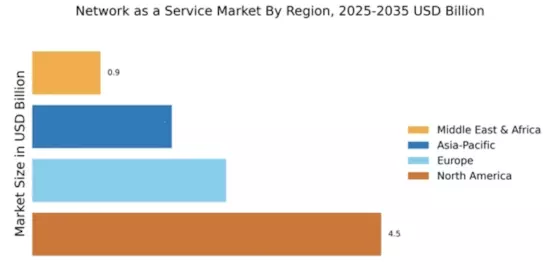

North America continues to lead the Network as a Service (NaaS) market, holding a significant share of 4.5 in 2024. The region's growth is driven by increasing demand for cloud-based solutions, enhanced connectivity, and the rise of remote work. Regulatory support for digital transformation and investments in 5G infrastructure further catalyze market expansion. Companies are increasingly adopting NaaS to improve operational efficiency and reduce costs, making it a vital component of their IT strategies. The competitive landscape in North America is robust, featuring key players such as Amazon Web Services, Microsoft, and Google Cloud. These companies are at the forefront of innovation, offering diverse NaaS solutions tailored to various industries. The presence of established tech giants and a thriving startup ecosystem fosters a dynamic environment for growth. As organizations prioritize agility and scalability, the demand for NaaS is expected to surge, solidifying North America's position as a market leader.

Europe : Emerging Market with Potential

Europe's Network as a Service market is poised for growth, with a market size of 2.5 in 2024. The region benefits from increasing digitalization, regulatory frameworks promoting cloud adoption, and a focus on sustainability. Governments are encouraging the transition to cloud services, which is driving demand for NaaS solutions. The rise of remote work and the need for flexible IT infrastructure are also significant factors contributing to market growth. Leading countries in Europe, such as Germany, the UK, and France, are witnessing a surge in NaaS adoption. The competitive landscape includes major players like IBM and Oracle, who are investing in innovative solutions to meet evolving customer needs. The presence of various startups and established firms enhances competition, fostering a vibrant ecosystem. As organizations seek to optimize their operations, the NaaS market in Europe is expected to expand significantly.

Asia-Pacific : Rapidly Growing Digital Landscape

The Asia-Pacific region is experiencing a rapid increase in Network as a Service (NaaS) adoption, with a market size of 1.8 in 2024. Factors such as rising internet penetration, the proliferation of mobile devices, and government initiatives to promote digital infrastructure are driving this growth. The demand for flexible and scalable IT solutions is pushing organizations to adopt NaaS, enabling them to respond quickly to market changes and customer needs. Countries like China, Japan, and India are leading the charge in NaaS adoption, supported by significant investments in technology and infrastructure. Major players such as Alibaba Cloud and NTT Communications are expanding their offerings to cater to the growing demand. The competitive landscape is becoming increasingly dynamic, with both established companies and startups vying for market share. As businesses prioritize digital transformation, the NaaS market in Asia-Pacific is set for substantial growth.

Middle East and Africa : Emerging Market with Opportunities

The Middle East and Africa (MEA) region is gradually unlocking its potential in the Network as a Service (NaaS) market, with a market size of 0.88 in 2024. The growth is driven by increasing investments in digital infrastructure, government initiatives to promote cloud adoption, and a rising demand for flexible IT solutions. As organizations in the region seek to enhance operational efficiency, NaaS is becoming an attractive option for businesses looking to modernize their IT environments. Leading countries such as the UAE and South Africa are at the forefront of NaaS adoption, supported by favorable regulatory frameworks and investments in technology. The competitive landscape includes both global players and local providers, creating a diverse market environment. As the region continues to embrace digital transformation, the NaaS market is expected to grow, offering significant opportunities for both established companies and new entrants.