Natural Organic Cosmetics Size

Natural Organic Cosmetics Market Growth Projections and Opportunities

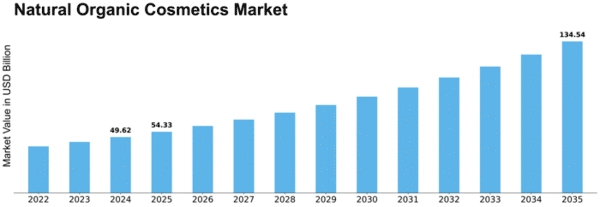

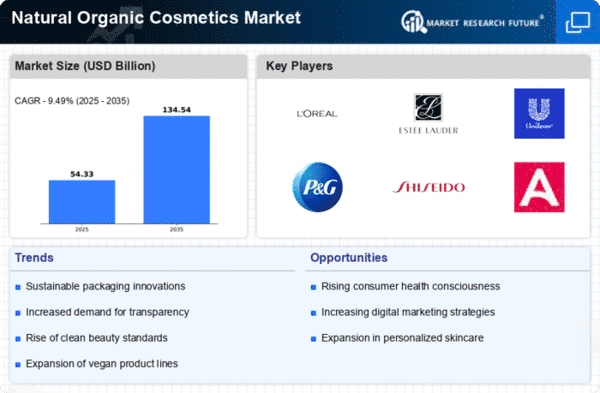

The global Natural and Organic Cosmetics market is on a trajectory to witness substantial growth, projected at a robust Compound Annual Growth Rate (CAGR) of 9.7% throughout the forecast period from 2022 to 2030. This expansion is fundamentally propelled by a surge in customer demand for cosmetics infused with natural ingredients and the influential impact of social media. An evolving trend in favor of natural & organic cosmetics is predominantly driven by heightened consumer awareness regarding the potential harm posed by certain chemicals found in conventional cosmetics. Consumers are increasingly favoring all-natural products devoid of artificial additives, considering them safer and more appealing. Moreover, the willingness of consumers to pay premium prices for these natural and organic alternatives stems from their perceived benefits and safety, coupled with factors like increased urbanization and a rise in per capita disposable income.

The growth potential of the natural & organic cosmetics market is further augmented by significant investments in Research and Development (R&D) by key market players. This strategic focus on R&D aims to expand the product range, thus fueling market expansion. Market participants are leveraging substantial investments and global partnerships, releasing innovative products, acquiring businesses, and collaborating with various organizations to fortify their foothold in the industry. However, amidst this burgeoning landscape, companies operating in the natural and organic cosmetics sector are compelled to offer competitively priced products to thrive in a fiercely competitive market and sustain growth.

Despite this optimistic growth trajectory, certain challenges loom over the horizon, acting as potential inhibitors for the natural & organic cosmetics market during the projected period. The inherent short shelf life of natural and organic products poses a significant challenge for manufacturers, impacting their shelf presence and shelf-life stability compared to synthetic cosmetics. Moreover, the availability and growing popularity of cutting-edge cosmetic procedures present a counterforce to the market growth. These advancements in cosmetic procedures offer consumers alternative means to achieve desired results, potentially diverting attention away from natural & organic cosmetics.

In essence, while the natural and organic cosmetics market is poised for substantial growth driven by consumer preferences, evolving market dynamics, and strategic industry initiatives, overcoming challenges related to product shelf life and competing cosmetic procedures remains pivotal for sustained market expansion and continued success in this competitive landscape.

Leave a Comment