Rising Consumer Awareness

The Organic and Natural Feminine Care Market is experiencing a notable increase in consumer awareness regarding the health implications of personal care products. As individuals become more informed about the potential risks associated with synthetic chemicals, there is a growing preference for organic and natural alternatives. This shift is reflected in market data, which indicates that the demand for organic feminine hygiene products has surged by approximately 20% over the past year. Consumers are actively seeking products that are free from harmful additives, which is driving innovation and expansion within the Organic and Natural Feminine Care Market.

Increased Focus on Women's Health

There is a growing emphasis on women's health and wellness, which is significantly influencing the Organic and Natural Feminine Care Market. As women become more proactive about their health, they are seeking products that align with their values and health goals. This trend is reflected in the rising sales of organic menstrual products and intimate care items, which have seen a growth rate of 18% in recent years. The focus on holistic health and well-being is prompting brands to develop innovative solutions that cater to the specific needs of women, thereby enhancing the overall appeal of the Organic and Natural Feminine Care Market.

Shift Towards Eco-Friendly Packaging

The Organic and Natural Feminine Care Market is witnessing a significant shift towards eco-friendly packaging solutions. As environmental concerns become more pronounced, consumers are increasingly favoring brands that prioritize sustainability in their packaging choices. This trend is evidenced by a 30% increase in sales for products utilizing biodegradable or recyclable materials. Companies are responding by innovating their packaging strategies, which not only aligns with consumer values but also enhances brand loyalty. The emphasis on sustainable packaging is likely to play a crucial role in shaping the future landscape of the Organic and Natural Feminine Care Market.

Regulatory Support for Natural Products

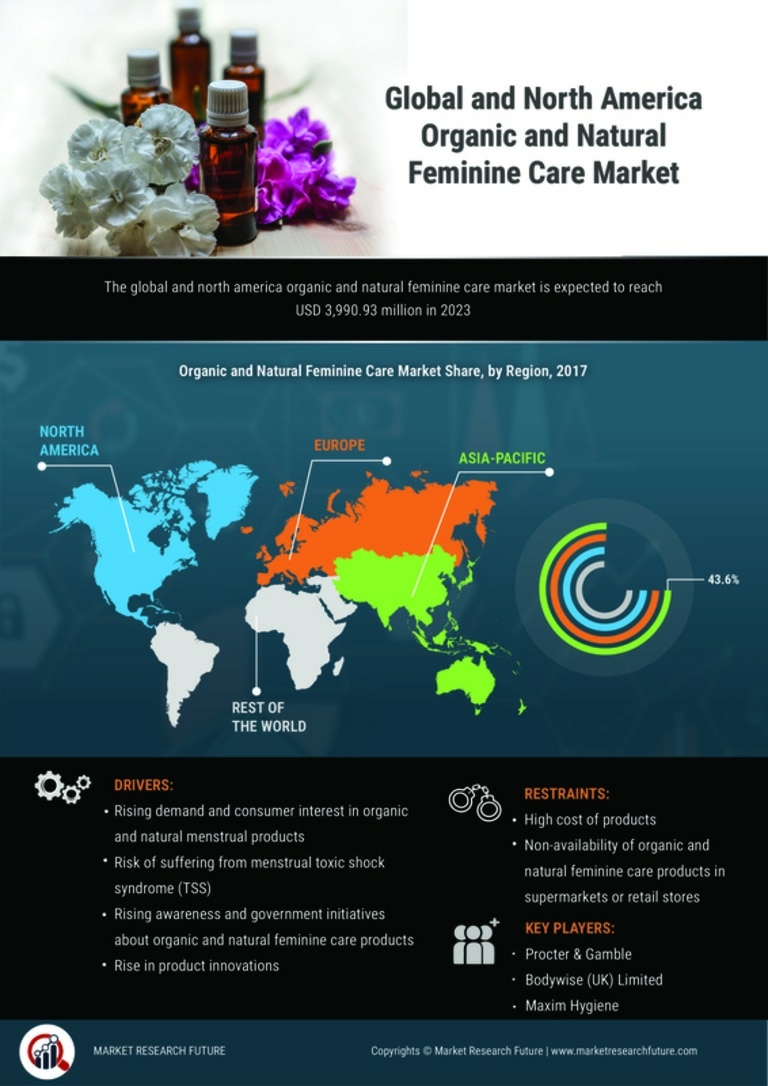

Regulatory frameworks are increasingly favoring the Organic and Natural Feminine Care Market, as governments worldwide implement stricter guidelines on chemical usage in personal care products. This regulatory support not only encourages manufacturers to adopt organic practices but also enhances consumer trust in these products. For instance, recent legislation has mandated clearer labeling of ingredients, allowing consumers to make informed choices. As a result, the market for organic feminine care products is projected to grow at a compound annual growth rate of 15% over the next five years, indicating a robust future for the Organic and Natural Feminine Care Market.

Influence of Social Media and Influencers

The rise of social media platforms has profoundly impacted the Organic and Natural Feminine Care Market. Influencers and health advocates are leveraging these platforms to promote awareness about the benefits of organic feminine care products. This digital marketing strategy has proven effective, as it reaches a broad audience and fosters community discussions around personal care choices. Market analysis suggests that brands engaging with influencers see a 25% increase in consumer engagement and sales. Consequently, the influence of social media is likely to continue driving growth and shaping consumer perceptions within the Organic and Natural Feminine Care Market.