North America : Defense Innovation Leader

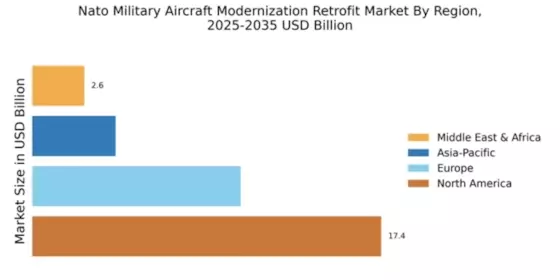

North America leads the NATO Military Aircraft Modernization Retrofit Market, holding a significant market share of 17.38 in 2024. The region's growth is driven by increasing defense budgets, technological advancements, and a focus on enhancing military capabilities. Regulatory support from government initiatives further catalyzes demand for modernization projects, ensuring that military aircraft remain competitive and effective in evolving combat scenarios.

The United States is the primary player in this market, with key companies like Lockheed Martin, Northrop Grumman, and Raytheon Technologies leading the charge. The competitive landscape is characterized by innovation and collaboration among defense contractors, ensuring that North America remains at the forefront of military modernization efforts. The presence of advanced research facilities and a skilled workforce further solidifies the region's dominance.

Europe : Strategic Defense Collaborations

Europe's NATO Military Aircraft Modernization Retrofit Market is projected at 10.38, reflecting a growing demand for advanced military capabilities. The region's growth is fueled by collaborative defense initiatives among NATO members, increased defense spending, and a focus on interoperability among allied forces. Regulatory frameworks are evolving to support modernization efforts, ensuring compliance with NATO standards and enhancing operational readiness.

Leading countries in this market include the UK, Germany, and France, with key players such as BAE Systems, Airbus, and Thales Group driving innovation. The competitive landscape is marked by strategic partnerships and joint ventures aimed at developing cutting-edge technologies. As European nations prioritize defense modernization, the market is expected to witness significant growth, bolstered by government support and investment in advanced military systems.

Asia-Pacific : Emerging Defense Market

The Asia-Pacific region, with a market size of 4.15, is witnessing a surge in demand for NATO Military Aircraft Modernization Retrofit solutions. This growth is driven by rising geopolitical tensions, increased defense budgets, and a commitment to enhancing military capabilities. Countries in this region are increasingly recognizing the importance of modernizing their aircraft fleets to meet contemporary security challenges, supported by favorable government policies and international collaborations.

Key players in this market include Hindustan Aeronautics Limited and various local defense contractors. The competitive landscape is evolving, with countries like India, Japan, and South Korea investing heavily in modernization programs. As these nations seek to bolster their defense capabilities, the market is expected to expand, driven by technological advancements and strategic partnerships with established defense firms.

Middle East and Africa : Growing Defense Investments

The Middle East and Africa region, with a market size of 2.59, is increasingly focusing on NATO Military Aircraft Modernization Retrofit initiatives. The growth in this market is driven by rising defense expenditures, regional conflicts, and a strategic emphasis on enhancing military capabilities. Governments are prioritizing modernization projects to ensure their air forces remain competitive and effective in addressing security threats, supported by international partnerships and defense cooperation agreements.

Leading countries in this region include the UAE, Saudi Arabia, and South Africa, with key players such as Thales Group and local defense contractors playing significant roles. The competitive landscape is characterized by a mix of established firms and emerging players, all vying to capture market share in a rapidly evolving defense environment. As investments in military modernization continue to rise, the region is poised for substantial growth.