North America : Established Market with Growth Potential

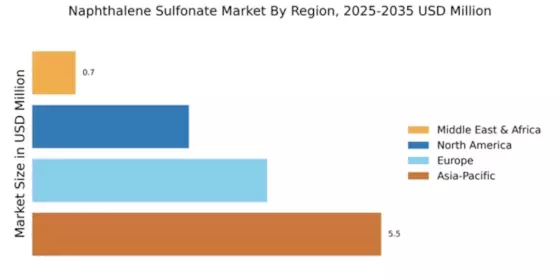

The North American Naphthalene Sulfonate market, valued at $2.47 billion, is witnessing steady growth driven by increasing demand in construction and automotive sectors. Regulatory support for sustainable materials and innovations in chemical formulations are key catalysts. The region's focus on infrastructure development and eco-friendly products is expected to further boost market dynamics, with a projected growth rate of 4-5% annually.

Leading countries like the US and Canada dominate the market, supported by major players such as BASF SE and Huntsman Corporation. The competitive landscape is characterized by strategic partnerships and technological advancements. Companies are investing in R&D to enhance product performance and meet evolving customer needs, ensuring a robust market presence in North America.

Europe : Innovation and Sustainability Focus

Europe's Naphthalene Sulfonate market, valued at €3.7 billion, is driven by stringent environmental regulations and a shift towards sustainable construction materials. The region's commitment to reducing carbon footprints and enhancing energy efficiency is fostering demand for innovative chemical solutions. Regulatory frameworks are encouraging the adoption of eco-friendly alternatives, positioning Europe as a leader in sustainable practices within the industry.

Germany, France, and the UK are key players in this market, with companies like Clariant AG and Solvay SA leading the charge. The competitive landscape is marked by a strong emphasis on R&D and collaboration among industry stakeholders. As the market evolves, European firms are focusing on developing high-performance products that align with regulatory standards and consumer preferences, ensuring continued growth in this sector.

Asia-Pacific : Emerging Powerhouse in Chemical Market

The Asia-Pacific region, with a market size of $5.5 billion, is the largest player in the Naphthalene Sulfonate market, driven by rapid industrialization and urbanization. Countries like China and India are experiencing significant growth in construction and automotive sectors, leading to increased demand for Naphthalene Sulfonate. Government initiatives promoting infrastructure development and investment in green technologies are further propelling market expansion.

China stands out as a dominant force, hosting key players such as Wuxi Dingsheng Chemical Co., Ltd. and Nippon Shokubai Co., Ltd. The competitive landscape is characterized by a mix of local and international companies, with a focus on innovation and cost-effective production methods. As the region continues to grow, the presence of major chemical manufacturers is expected to strengthen, ensuring a robust market environment in Asia-Pacific.

Middle East and Africa : Resource-Rich Frontier for Chemicals

The Middle East and Africa (MEA) Naphthalene Sulfonate market, valued at $0.68 billion, is gradually expanding, driven by increasing industrial activities and infrastructure projects. The region's rich natural resources and strategic location are attracting investments in chemical manufacturing. Government initiatives aimed at diversifying economies and enhancing local production capabilities are key growth drivers in this market.

Countries like Saudi Arabia and South Africa are leading the charge, with a growing number of local manufacturers entering the market. The competitive landscape is evolving, with both regional and international players vying for market share. As the MEA region continues to develop its industrial base, the demand for Naphthalene Sulfonate is expected to rise, supported by ongoing investments in infrastructure and construction projects.