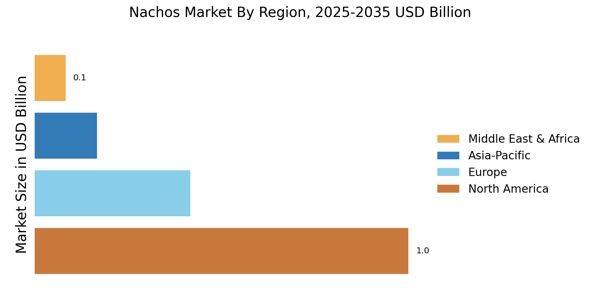

North America : Snack Food Powerhouse

North America is the largest market for nachos, accounting for approximately 60% of global consumption. The region's growth is driven by increasing snacking trends, the popularity of convenience foods, and a strong culture of social gatherings. Regulatory support for food safety and quality standards further enhances market stability. The U.S. is the leading country, followed by Canada, which contributes significantly to the overall market share.

The competitive landscape is dominated by major players such as Frito-Lay, Tostitos, and Doritos, which have established strong brand loyalty. The presence of diverse product offerings, including organic and gluten-free options, caters to evolving consumer preferences. The market is characterized by continuous innovation, with companies investing in new flavors and packaging to attract a broader audience. Overall, North America remains a vibrant hub for nacho products.

Europe : Emerging Snack Market

Europe is witnessing a growing demand for nachos, with a market share of around 25%. The rise in snacking culture, particularly among younger demographics, is a key driver of this growth. Countries like the UK and Germany are leading the market, supported by favorable regulations on food imports and safety standards. The increasing popularity of Mexican cuisine and the trend towards casual dining are also contributing to the expansion of the nachos market in this region.

The competitive landscape features both local and international brands, with key players like Doritos and Pringles leading the charge. The presence of artisanal and gourmet nacho products is on the rise, appealing to health-conscious consumers. Retail channels, including supermarkets and online platforms, are expanding their offerings, making nachos more accessible. This dynamic environment is fostering innovation and variety in product lines, enhancing consumer choice.

Asia-Pacific : Emerging Powerhouse

Asia-Pacific is emerging as a significant player in the nachos market, holding approximately 10% of the global share. The region's growth is fueled by urbanization, changing lifestyles, and a growing affinity for Western food trends. Countries like Japan and Australia are at the forefront, with increasing disposable incomes and a rising number of food service establishments. Regulatory frameworks supporting food safety and quality are also enhancing market growth.

The competitive landscape is characterized by a mix of local and international brands, with companies like Pringles and Doritos gaining traction. The introduction of unique flavors tailored to local tastes is becoming a trend, attracting a diverse consumer base. Retail expansion, particularly in e-commerce, is making nachos more accessible to consumers. As the market continues to evolve, innovation in product offerings will play a crucial role in capturing consumer interest.

Middle East and Africa : Untapped Snack Potential

The Middle East and Africa region is gradually emerging in the nachos market, currently holding about 5% of the global share. The growth is driven by increasing urbanization, a young population, and a rising trend towards snacking. Countries like South Africa and the UAE are leading the market, supported by favorable trade regulations and a growing food service sector. The region's diverse culinary landscape is also paving the way for innovative nacho products.

The competitive landscape is still developing, with both local and international brands vying for market share. Key players are beginning to introduce nachos with unique flavors and ingredients that cater to local tastes. Retail channels are expanding, with supermarkets and convenience stores increasing their snack offerings. As consumer awareness of nachos grows, the market is expected to see significant growth in the coming years.