Increased Research Funding

The allocation of increased research funding for neurological disorders is likely to bolster the Multi-Infarct Dementia Market. Governments and private organizations are recognizing the need for comprehensive research into the underlying mechanisms and potential treatments for Multi-Infarct Dementia. This influx of funding may facilitate clinical trials and the development of innovative therapies, ultimately enhancing patient outcomes. Recent initiatives have shown a commitment to addressing cognitive disorders, with funding levels for neurological research rising by approximately 15% over the past few years. Such financial support is essential for advancing the understanding of Multi-Infarct Dementia and fostering breakthroughs in treatment.

Growing Geriatric Population

The increasing geriatric population is a significant factor influencing the Multi-Infarct Dementia Market. As individuals age, the risk of developing cognitive disorders, including Multi-Infarct Dementia, escalates. Current projections indicate that by 2030, the number of people aged 65 and older will surpass 1 billion, creating a substantial demand for healthcare services tailored to this demographic. This demographic shift necessitates a focus on cognitive health, prompting healthcare systems to invest in research and treatment options for age-related conditions. Consequently, the Multi-Infarct Dementia Market is poised for growth as it adapts to meet the needs of an aging population.

Technological Innovations in Treatment

Technological advancements in treatment modalities are likely to play a crucial role in shaping the Multi-Infarct Dementia Market. Innovations such as neuroprotective agents and advanced imaging techniques may enhance the understanding and management of this condition. For instance, the introduction of new imaging technologies has improved the ability to detect brain lesions associated with Multi-Infarct Dementia, facilitating earlier diagnosis and intervention. Furthermore, the development of novel pharmacological treatments could provide new avenues for managing symptoms and slowing disease progression. As these technologies evolve, they may significantly impact the therapeutic landscape, driving growth within the Multi-Infarct Dementia Market.

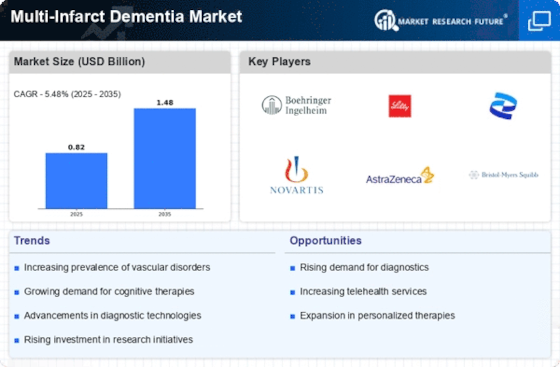

Increasing Prevalence of Vascular Diseases

The rising incidence of vascular diseases, including hypertension and diabetes, appears to be a primary driver for the Multi-Infarct Dementia Market. As these conditions contribute significantly to the development of Multi-Infarct Dementia, the growing number of affected individuals may lead to an increased demand for diagnostic and therapeutic solutions. Recent statistics indicate that approximately 30% of individuals with hypertension may develop cognitive impairments, which underscores the urgency for effective interventions. This trend suggests that healthcare providers and stakeholders in the Multi-Infarct Dementia Market must prioritize strategies to address the cognitive decline associated with vascular diseases, potentially leading to innovative treatment options and enhanced patient care.

Rising Demand for Home Healthcare Services

The growing demand for home healthcare services is emerging as a pivotal driver for the Multi-Infarct Dementia Market. As patients and families increasingly prefer receiving care in the comfort of their homes, there is a corresponding need for specialized services tailored to individuals with cognitive impairments. This trend is particularly relevant for those with Multi-Infarct Dementia, as they often require ongoing support and monitoring. The home healthcare market has expanded significantly, with estimates suggesting a growth rate of around 10% annually. This shift towards home-based care may lead to increased investment in training and resources for caregivers, thereby enhancing the quality of life for patients and driving growth within the Multi-Infarct Dementia Market.