Increasing Motorcycle Ownership

The rise in motorcycle ownership is a pivotal driver for the Motorcycle Insurance Market. As urbanization continues to expand, more individuals are opting for motorcycles as a cost-effective and efficient mode of transportation. In many regions, the number of registered motorcycles has seen a steady increase, with estimates suggesting that ownership could rise by 5 to 7% annually. This surge in ownership necessitates corresponding insurance coverage, thereby propelling the demand for motorcycle insurance policies. Furthermore, the growing popularity of motorcycle riding as a leisure activity contributes to this trend, as enthusiasts seek to protect their investments through comprehensive insurance solutions. Consequently, the Motorcycle Insurance Market is likely to experience significant growth as more riders enter the market, seeking tailored insurance products that meet their specific needs.

Regulatory Changes and Compliance

Regulatory changes play a crucial role in shaping the Motorcycle Insurance Market. Governments worldwide are increasingly implementing stricter regulations regarding motorcycle safety and insurance requirements. For instance, many jurisdictions now mandate minimum liability coverage for motorcycle riders, which directly influences the demand for insurance products. Additionally, the push for enhanced safety standards may lead to the introduction of new insurance products that cater to these regulatory requirements. As compliance becomes more complex, insurers must adapt their offerings to meet these evolving standards, potentially leading to an increase in policy premiums. This dynamic environment indicates that the Motorcycle Insurance Market must remain agile and responsive to regulatory shifts, ensuring that both insurers and consumers are adequately protected.

Growing Awareness of Insurance Benefits

The growing awareness of the benefits of motorcycle insurance is a significant driver for the Motorcycle Insurance Market. As more riders recognize the financial protection that insurance provides against theft, accidents, and liability claims, the demand for comprehensive coverage is likely to increase. Educational campaigns and outreach initiatives by insurers have contributed to this heightened awareness, emphasizing the importance of safeguarding one's investment. Furthermore, the rise of online platforms has made it easier for consumers to compare policies and understand their options, fostering informed decision-making. This trend suggests that the Motorcycle Insurance Market is poised for growth, as more individuals seek to secure their motorcycles with appropriate insurance coverage, thereby mitigating potential risks associated with riding.

Technological Advancements in Insurance

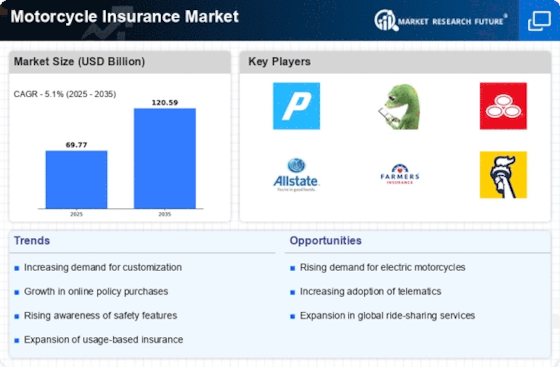

Technological advancements are reshaping the Motorcycle Insurance Market in profound ways. The integration of telematics and mobile applications allows insurers to offer personalized policies based on individual riding behavior. This data-driven approach not only enhances risk assessment but also enables insurers to provide discounts for safe riding practices. Moreover, the adoption of artificial intelligence in claims processing streamlines operations, reducing turnaround times and improving customer satisfaction. As technology continues to evolve, it is anticipated that the Motorcycle Insurance Market will witness an influx of innovative products and services, catering to the tech-savvy consumer. The potential for increased efficiency and customer engagement through these advancements suggests a promising future for the industry, as insurers adapt to the changing landscape of consumer expectations.

Expansion of E-commerce in Insurance Sales

The expansion of e-commerce is transforming the Motorcycle Insurance Market by providing consumers with convenient access to insurance products. Online platforms enable riders to obtain quotes, compare policies, and purchase coverage from the comfort of their homes. This shift towards digital sales channels is particularly appealing to younger consumers, who prefer the ease and efficiency of online transactions. As e-commerce continues to grow, it is expected that more insurers will enhance their online presence, offering tailored products that cater to the specific needs of motorcycle riders. This trend not only increases competition among insurers but also empowers consumers to make informed choices. Consequently, the Motorcycle Insurance Market is likely to benefit from this digital transformation, as it aligns with the evolving preferences of modern consumers.