Rising Travel Activity

The Travel Insurance Market is experiencing a notable surge in travel activity, driven by an increase in disposable income and a growing middle class in various regions. As more individuals embark on international trips, the demand for travel insurance is likely to rise. According to recent data, the number of outbound travelers has increased by approximately 10% annually, indicating a robust trend. This uptick in travel not only enhances the need for protection against unforeseen events but also encourages travelers to seek comprehensive coverage options. Consequently, the Travel Insurance Market is poised for growth as consumers prioritize safety and security during their journeys.

Regulatory Developments

The Travel Insurance Market is influenced by evolving regulatory frameworks that aim to enhance consumer protection. Governments are increasingly mandating that travelers obtain insurance coverage, particularly for international travel. This regulatory push is likely to bolster the market, as compliance becomes a necessity for travelers. For instance, certain countries have implemented laws requiring proof of insurance for entry, thereby driving demand for travel insurance products. As regulations continue to evolve, the Travel Insurance Market may witness a shift towards more standardized offerings, ensuring that consumers receive adequate protection while traveling.

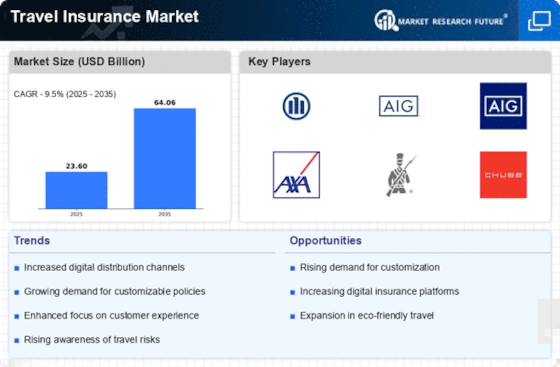

Technological Integration

The Travel Insurance Market is increasingly benefiting from technological advancements that streamline the purchasing process and enhance customer experience. The rise of digital platforms and mobile applications has made it easier for consumers to compare policies, obtain quotes, and purchase insurance online. Recent statistics indicate that over 50% of travel insurance purchases are now made through digital channels, reflecting a significant shift in consumer behavior. This technological integration not only improves accessibility but also allows for personalized insurance solutions, catering to the diverse needs of travelers. As technology continues to evolve, the Travel Insurance Market is expected to further innovate, providing consumers with more efficient and user-friendly options.

Growing Demand for Customization

The Travel Insurance Market is experiencing a growing demand for customized insurance solutions that cater to individual traveler needs. As consumers become more discerning, they seek policies that align with their specific travel plans and preferences. This trend is evident in the increasing popularity of add-on coverage options, such as adventure sports or trip interruption insurance. Market data suggests that nearly 40% of travelers are willing to pay extra for tailored coverage, indicating a shift towards personalization in the insurance sector. Consequently, the Travel Insurance Market is likely to evolve, offering more flexible and customizable products that resonate with the diverse requirements of modern travelers.

Increased Focus on Health and Safety

The Travel Insurance Market is witnessing a heightened emphasis on health and safety, particularly in the context of travel. Travelers are becoming more aware of potential health risks associated with their journeys, leading to a greater demand for insurance products that cover medical emergencies and trip cancellations. Data suggests that approximately 60% of travelers now consider health coverage as a critical factor when purchasing travel insurance. This trend indicates a shift in consumer priorities, as individuals seek policies that provide comprehensive health-related benefits. As a result, the Travel Insurance Market is likely to adapt by offering tailored solutions that address these emerging concerns.