Rising Demand for Safety Features

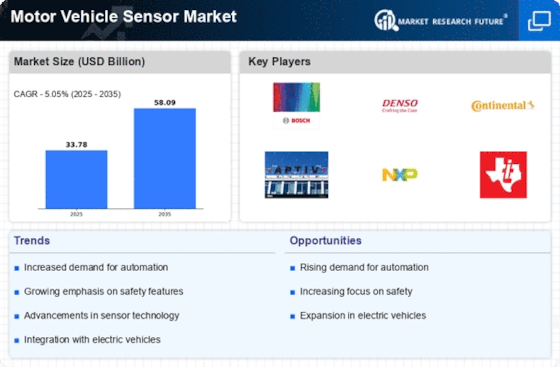

The Motor Vehicle Sensor Market is experiencing a notable surge in demand for enhanced safety features in vehicles. Consumers are increasingly prioritizing safety, leading manufacturers to integrate advanced sensor technologies. According to recent data, the market for automotive safety sensors is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This growth is driven by the implementation of regulations mandating safety standards, which necessitate the incorporation of sensors for collision avoidance, lane departure warnings, and pedestrian detection. As a result, the Motor Vehicle Sensor Market is likely to witness a significant uptick in sensor deployment, as automakers strive to meet consumer expectations and regulatory requirements.

Government Regulations and Standards

Government regulations and standards are a critical driver of the Motor Vehicle Sensor Market. Regulatory bodies are increasingly mandating the inclusion of advanced sensor technologies in vehicles to enhance safety and reduce accidents. For instance, regulations requiring the installation of automatic emergency braking systems are pushing manufacturers to adopt more sophisticated sensor solutions. This regulatory landscape is expected to create a favorable environment for sensor manufacturers, as compliance with safety standards becomes a priority for automakers. The Motor Vehicle Sensor Market is likely to benefit from these regulations, as they drive innovation and investment in sensor technologies to meet evolving safety requirements.

Expansion of Connected Vehicle Technologies

The expansion of connected vehicle technologies is significantly influencing the Motor Vehicle Sensor Market. As vehicles become increasingly connected through the Internet of Things (IoT), the demand for sensors that facilitate communication between vehicles and infrastructure is growing. These sensors enable features such as vehicle-to-vehicle communication, traffic management, and real-time data sharing. The market for connected vehicle sensors is anticipated to grow at a rapid pace, with estimates suggesting a potential market size of over $30 billion by 2027. This trend indicates a shift towards smarter transportation systems, which will likely enhance the overall functionality and safety of vehicles in the Motor Vehicle Sensor Market.

Technological Advancements in Sensor Technology

Technological advancements are playing a pivotal role in shaping the Motor Vehicle Sensor Market. Innovations in sensor technology, such as the development of LiDAR, radar, and camera systems, are enhancing vehicle capabilities. These advancements enable features like adaptive cruise control, automatic emergency braking, and parking assistance. The market for these advanced sensors is expected to reach a valuation of several billion dollars by 2026, reflecting a robust growth trajectory. Furthermore, the integration of artificial intelligence and machine learning algorithms into sensor systems is likely to improve their accuracy and reliability, thereby driving further adoption in the Motor Vehicle Sensor Market.

Increasing Focus on Environmental Sustainability

The Motor Vehicle Sensor Market is witnessing a shift towards environmental sustainability, driven by the growing awareness of climate change and the need for greener transportation solutions. As manufacturers pivot towards electric and hybrid vehicles, the demand for sensors that monitor battery performance, energy consumption, and emissions is on the rise. This trend is supported by government initiatives promoting eco-friendly vehicles, which are expected to bolster the sensor market. The market for environmental sensors in vehicles is projected to grow significantly, as automakers seek to comply with stringent emissions regulations and enhance the sustainability of their offerings within the Motor Vehicle Sensor Market.