Increased Regulatory Scrutiny

The Mortgage Brokerage Service Market is currently navigating a landscape of increased regulatory scrutiny. Governments are implementing stricter regulations to ensure transparency and protect consumers in the mortgage process. This trend has led to a more complex compliance environment for mortgage brokers, necessitating a thorough understanding of legal requirements. While this may pose challenges, it also presents opportunities for brokers to differentiate themselves by offering compliant and ethical services. Data indicates that firms that prioritize regulatory adherence are more likely to build trust with clients, thereby enhancing their reputation in the Mortgage Brokerage Service Market. As regulations evolve, brokers must remain agile to adapt to these changes.

Rising Demand for Homeownership

The Mortgage Brokerage Service Market is experiencing a notable increase in demand for homeownership. As more individuals seek to invest in real estate, the role of mortgage brokers becomes increasingly vital. Recent data indicates that homeownership rates have been steadily rising, with a significant portion of the population prioritizing property acquisition. This trend is likely driven by favorable interest rates and a growing awareness of the benefits of owning versus renting. Consequently, mortgage brokers are positioned to facilitate this demand by providing tailored financing solutions. The Mortgage Brokerage Service Market is thus poised for growth as brokers adapt to the evolving needs of prospective homeowners, ensuring they have access to the most suitable mortgage products available.

Demographic Shifts and Urbanization

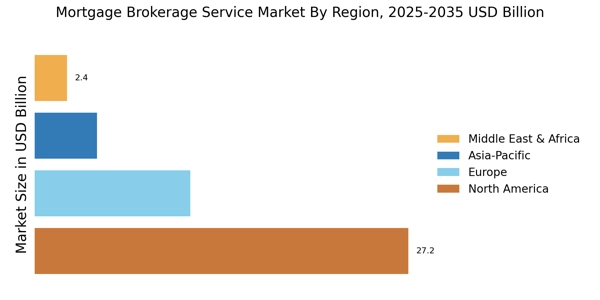

Demographic shifts and urbanization are significantly influencing the Mortgage Brokerage Service Market. As populations migrate towards urban centers, the demand for housing in these areas is surging. This urbanization trend is accompanied by a younger demographic that is increasingly interested in homeownership. Recent data indicates that millennials and Gen Z are entering the housing market in larger numbers, seeking properties that align with their lifestyle preferences. Mortgage brokers are essential in this context, as they provide guidance and access to financing options tailored to these younger buyers. The Mortgage Brokerage Service Market is thus likely to benefit from these demographic changes, as brokers position themselves to cater to the needs of a new generation of homeowners.

Growing Interest in Alternative Financing Options

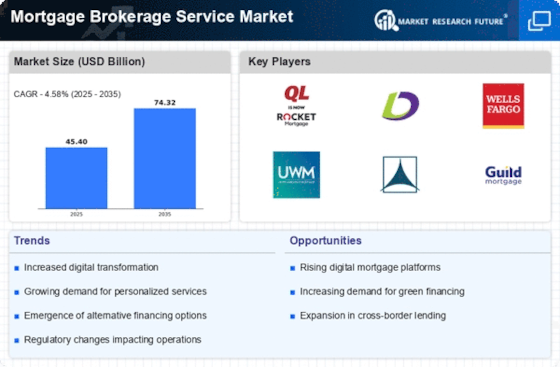

The Mortgage Brokerage Service Market is witnessing a growing interest in alternative financing options. As traditional lending criteria become more stringent, borrowers are increasingly exploring non-conventional mortgage products, such as peer-to-peer lending and private equity financing. This shift is indicative of a broader trend where consumers seek flexibility and tailored solutions that align with their unique financial situations. Recent surveys reveal that nearly 25% of potential homebuyers are considering alternative financing methods. Mortgage brokers play a crucial role in this landscape by educating clients about these options and facilitating access to diverse funding sources. This trend is likely to expand the Mortgage Brokerage Service Market as brokers adapt to meet the evolving preferences of borrowers.

Technological Advancements in Mortgage Processing

Technological advancements are reshaping the Mortgage Brokerage Service Market, enhancing efficiency and customer experience. The integration of digital platforms and automated systems allows brokers to streamline the mortgage application process, reducing turnaround times significantly. Recent statistics suggest that the adoption of technology in mortgage processing has led to a 30% increase in operational efficiency for many brokerage firms. This shift not only improves service delivery but also attracts a tech-savvy clientele who prefer online interactions. As the Mortgage Brokerage Service Market continues to embrace innovation, brokers who leverage these technologies are likely to gain a competitive edge, ultimately driving market growth.