Rising Healthcare Expenditure

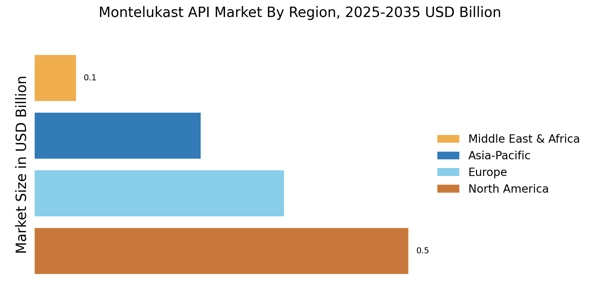

An increase in healthcare expenditure across various regions is a significant driver for the Montelukast API Market. As countries allocate more resources to healthcare, there is a corresponding rise in the availability and accessibility of medications for chronic conditions such as asthma and allergies. This trend is particularly evident in emerging economies, where healthcare reforms are aimed at improving patient outcomes. The Montelukast API Market, being a cost-effective treatment option, is likely to benefit from this increased spending. Furthermore, the emphasis on preventive healthcare and chronic disease management aligns with the therapeutic profile of Montelukast, suggesting a favorable market environment for its continued growth.

Regulatory Approvals and Guidelines

The Montelukast API Market is significantly influenced by regulatory approvals and clinical guidelines that endorse the use of Montelukast for various respiratory conditions. Regulatory bodies, such as the FDA and EMA, have established guidelines that facilitate the approval process for new formulations and generics of Montelukast. This regulatory support not only enhances market accessibility but also encourages pharmaceutical companies to invest in research and development. As a result, the market is witnessing an influx of new entrants and innovative formulations, which could potentially expand the therapeutic applications of Montelukast. The alignment of clinical guidelines with emerging research further solidifies the role of Montelukast in asthma and allergy management, thereby driving market growth.

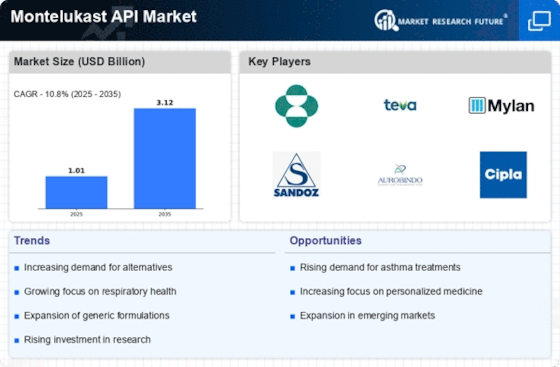

Increasing Prevalence of Asthma and Allergies

The rising incidence of asthma and allergic conditions is a primary driver for the Montelukast API Market. According to recent data, asthma affects approximately 300 million individuals worldwide, with a notable increase in prevalence among children. This growing patient population necessitates effective treatment options, thereby propelling the demand for Montelukast, a well-established leukotriene receptor antagonist. As healthcare providers seek to manage these chronic conditions more effectively, the Montelukast API Market is likely to experience substantial growth. Furthermore, the increasing awareness of asthma management strategies among patients and healthcare professionals contributes to the heightened demand for Montelukast, reinforcing its position in the therapeutic landscape.

Technological Advancements in Drug Delivery Systems

Technological advancements in drug delivery systems are poised to impact the Montelukast API Market positively. Innovations such as smart inhalers and sustained-release formulations enhance the efficacy and patient compliance of Montelukast. These advancements not only improve the therapeutic outcomes for patients but also create new market opportunities for pharmaceutical companies. As the industry embraces these technologies, the Montelukast API Market is likely to be integrated into more sophisticated delivery systems, thereby expanding its market reach. The potential for personalized medicine, where treatments are tailored to individual patient needs, further underscores the importance of these technological developments in shaping the future of the Montelukast API Market.

Growing Awareness and Education on Respiratory Health

The increasing awareness and education regarding respiratory health are crucial drivers for the Montelukast API Market. Public health campaigns and educational initiatives aimed at asthma and allergy management have led to a greater understanding of these conditions among patients and healthcare providers. This heightened awareness encourages individuals to seek treatment options, including Montelukast, thereby driving demand. Additionally, healthcare professionals are more equipped to recommend Montelukast as a viable treatment option, further enhancing its market presence. The focus on respiratory health education is likely to continue, suggesting a sustained growth trajectory for the Montelukast API Market as more patients become informed about their treatment choices.