Research Methodology on Global Chronic Obstructive Pulmonary Disease Market

1. Introduction:

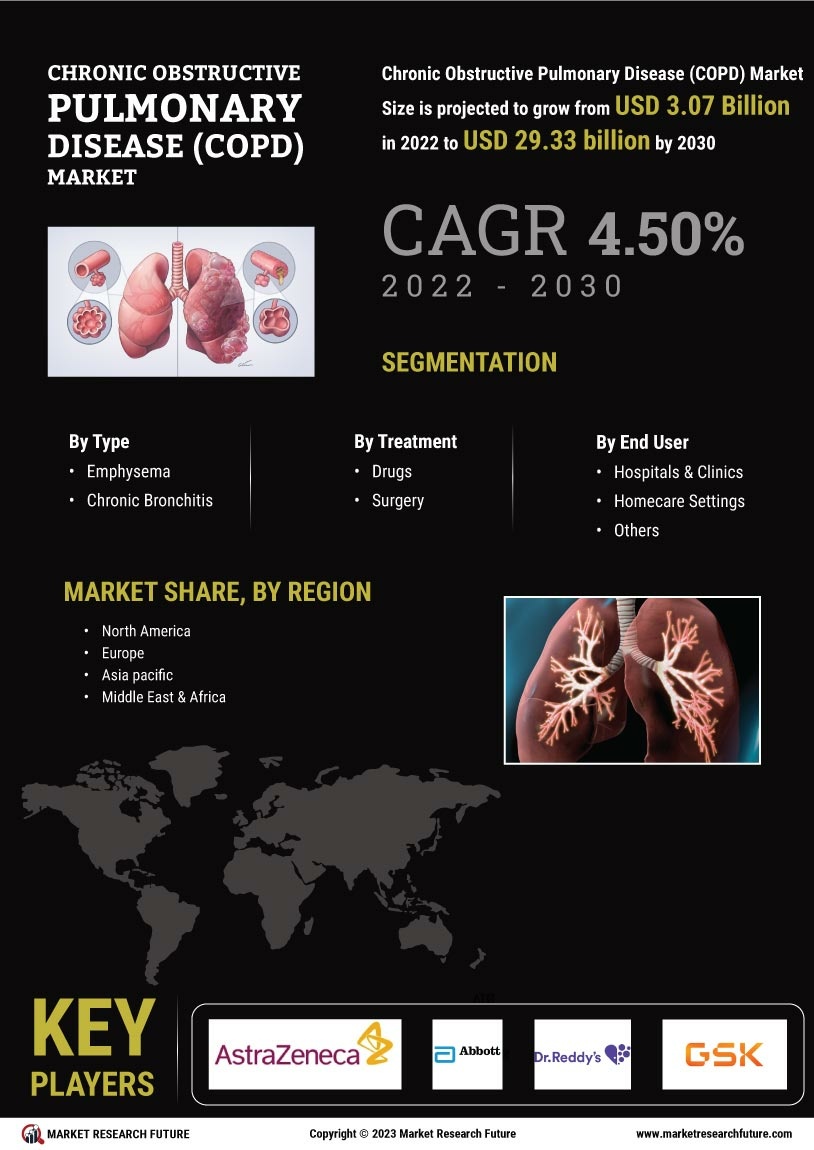

Chronic obstructive pulmonary disease (COPD) refers to a group of chronic lung diseases that have an obstructed airflow from the lungs, including emphysema, chronic bronchitis and/or asthma. It is one of the main causes of morbidity and mortality worldwide and its increasing prevalence has led to a strong interest in research into this condition. This report presents a comprehensive overview of the latest findings in COPD and provides an understanding of the current market trends and emerging treatments. The objective of this research is to provide insights into the COPD market, by analysing the current treatments, and recent developments and assessing their future impact on the market.

2. Literature review:

This research involves a literature review of existing published research studies, reports and literature in the field of COPD, to identify and analyse current trends, developments and treatments available. Relevant databases such as Medline, PubMed, MedlinePlus and ScienceDirect are searched for relevant studies and reports. Relevant articles are carefully screened and those relevant to the research topic are selected based on their level of methodological rigour and relevance to the objectives of the research. Once the relevant articles are identified, the data from each study is collated, appraised and analysed for its relevance and accuracy.

3. Data Collection and Analysis:

The next step in this research is to collect primary data using a qualitative research approach. Semi-structured interviews are conducted with doctors and specialists, key opinion leaders, healthcare professionals and representatives of drug & device manufacturers, to understand their views on the current COPD landscape. In addition to this, patient/consumer surveys are carried out to gain insights into patient/consumer opinions and preferences when it comes to COPD treatments. The primary data collected from these interviews and surveys are analysed using thematic analysis and results are interpreted.

4. Secondary Data Collection and Analysis:

In addition to primary data collection, secondary data is collected from various sources such as WHO, CDC, peer-reviewed journals, and trade reports. This data is analysed to gain an understanding of the current global epidemiology and market trends. Data from the secondary sources are collated, analysed and interpreted.

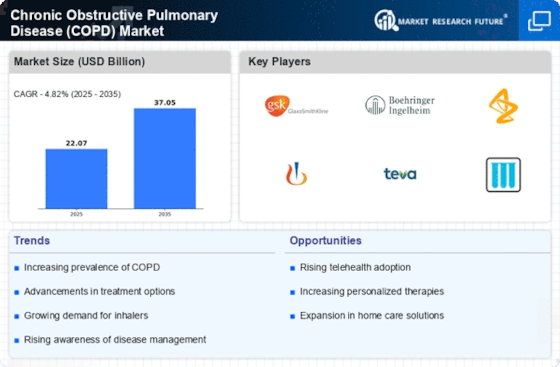

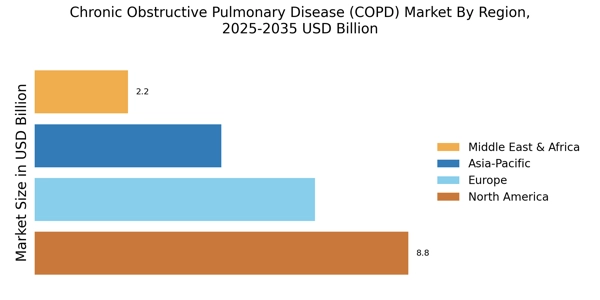

5. Findings and Recommendations:

The results of both primary and secondary data collection and analysis are presented in a comprehensive report. This report provides an insightful overview of the COPD market, including current treatments, recent developments, trends and future outlook. Furthermore, detailed recommendations are provided to help stakeholders make informed decisions when it comes to developing and marketing new COPD treatments.