Regulatory Influence on Safety Standards

Regulatory influence plays a pivotal role in shaping the Automotive Mono Camera Market. Governments worldwide are implementing stringent safety standards that necessitate the integration of advanced driver assistance systems (ADAS) in vehicles. These regulations often mandate the use of mono cameras for features such as automatic emergency braking and adaptive cruise control. As a consequence, manufacturers are compelled to invest in the development of high-quality mono cameras to comply with these regulations. The market is expected to witness a significant uptick in demand as more countries adopt similar safety regulations, potentially increasing the market size by 15% in the coming years.

Cost-Effectiveness of Mono Camera Solutions

The cost-effectiveness of mono camera solutions is becoming increasingly apparent within the Automotive Mono Camera Market. As manufacturers seek to optimize production costs while maintaining high safety standards, mono cameras present a viable alternative to more complex multi-camera systems. The simplicity of mono camera setups not only reduces manufacturing costs but also minimizes installation complexity. This economic advantage is particularly appealing to automakers looking to enhance their vehicle offerings without significantly increasing prices. Market analysis suggests that the adoption of mono cameras could lead to a 20% reduction in overall system costs for vehicle manufacturers, thereby driving further growth in the market.

Consumer Demand for Enhanced Safety Features

Consumer demand for enhanced safety features is a driving force in the Automotive Mono Camera Market. As awareness of road safety increases, consumers are increasingly seeking vehicles equipped with advanced safety technologies. Mono cameras are integral to these systems, providing critical data for features like collision avoidance and lane-keeping assistance. Market Research Future indicates that approximately 60% of consumers prioritize safety features when purchasing a vehicle, which is prompting manufacturers to incorporate more mono camera systems into their designs. This trend is likely to propel the market forward, with projections suggesting a 12% increase in mono camera installations in new vehicles over the next few years.

Technological Advancements in Imaging Systems

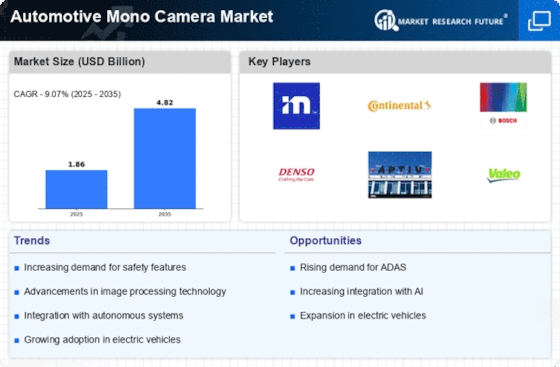

The Automotive Mono Camera Market is experiencing a surge in technological advancements, particularly in imaging systems. Enhanced image processing capabilities and the integration of artificial intelligence are driving the development of more sophisticated mono cameras. These advancements enable vehicles to better interpret their surroundings, improving safety and navigation. For instance, the incorporation of high-resolution sensors allows for clearer images, which is crucial for applications such as lane departure warnings and pedestrian detection. As a result, the market is projected to grow at a compound annual growth rate of approximately 10% over the next five years, reflecting the increasing reliance on advanced imaging technologies in automotive applications.

Integration with Autonomous Driving Technologies

The integration of mono cameras with autonomous driving technologies is reshaping the Automotive Mono Camera Market. As the automotive sector moves towards greater automation, the demand for reliable and efficient imaging systems is escalating. Mono cameras serve as a vital component in the sensor suite of autonomous vehicles, providing essential visual data for navigation and obstacle detection. The market is witnessing a shift, with an estimated 25% of new vehicles expected to feature some level of automation by 2030. This trend indicates a growing reliance on mono cameras, as they are crucial for the safe operation of autonomous driving systems.