Growing Demand for Genetic Testing

The rising prevalence of genetic disorders and cancers is significantly driving the demand for genetic testing within the Molecular Cytogenetics Market. As awareness of genetic conditions increases, more individuals seek testing for hereditary diseases, which in turn fuels the need for advanced cytogenetic techniques. According to recent estimates, the genetic testing market is expected to reach USD 20 billion by 2026, with molecular cytogenetics playing a pivotal role in this growth. This trend is further supported by healthcare providers advocating for early diagnosis and intervention strategies. Consequently, the demand for molecular cytogenetic tests is likely to expand, as they provide critical insights into genetic predispositions and treatment options.

Regulatory and Reimbursement Changes

The evolving regulatory landscape is influencing the Molecular Cytogenetics Market, particularly concerning reimbursement policies. As governments and health organizations recognize the importance of genetic testing, there is a push for more favorable reimbursement frameworks. This shift is expected to enhance accessibility to molecular cytogenetic tests, thereby increasing their adoption among healthcare providers. Recent changes in reimbursement policies have already shown a positive impact, with a reported increase in test utilization rates by approximately 15% in the past year. As reimbursement becomes more standardized, it is anticipated that the market will witness accelerated growth, as both patients and providers benefit from improved financial support for molecular cytogenetic services.

Rising Incidence of Genetic Disorders

The increasing incidence of genetic disorders is a critical driver for the Molecular Cytogenetics Market. With conditions such as Down syndrome, Turner syndrome, and various cancers becoming more prevalent, there is a heightened need for effective diagnostic tools. The World Health Organization has reported a steady rise in genetic disorders, which necessitates the use of advanced cytogenetic techniques for accurate diagnosis and management. This trend is likely to propel the market forward, as healthcare systems seek to implement comprehensive screening programs. Furthermore, the emphasis on early detection and intervention is expected to drive demand for molecular cytogenetic tests, thereby contributing to market expansion.

Growing Investment in Research and Development

Investment in research and development (R&D) is a significant driver of the Molecular Cytogenetics Market. As the scientific community continues to explore the complexities of the human genome, funding for innovative research is on the rise. This influx of investment is likely to lead to the development of novel molecular cytogenetic techniques and applications. For instance, advancements in gene editing technologies, such as CRISPR, are opening new avenues for research and therapeutic interventions. The market is expected to benefit from these developments, as they enhance the capabilities of molecular cytogenetics in diagnosing and treating genetic disorders. Consequently, the focus on R&D is anticipated to foster growth and innovation within the industry.

Technological Advancements in Molecular Cytogenetics

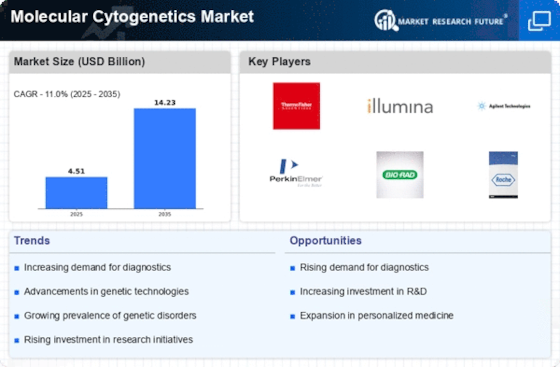

The Molecular Cytogenetics Market is experiencing a surge in technological advancements that enhance diagnostic capabilities. Innovations such as next-generation sequencing (NGS) and array comparative genomic hybridization (aCGH) are revolutionizing the field. These technologies allow for more precise detection of chromosomal abnormalities, which is crucial for personalized medicine. The market is projected to grow at a compound annual growth rate (CAGR) of approximately 10% over the next five years, driven by these advancements. Furthermore, the integration of artificial intelligence in data analysis is expected to streamline workflows and improve accuracy in genetic testing. As laboratories adopt these cutting-edge technologies, the demand for molecular cytogenetic solutions is likely to increase, thereby propelling the market forward.