Research Methodology on Molecular Modelling Market

The primary research methodology employed for creating this market research report was extensive primary research with both supply and demand sides of the market. The secondary research was done through various sources which include, but are not limited to company websites, paid databases, secondary sources such as scientific journals, government publications, and industry white papers etc. The market growth predictions and estimations and trends were provided by experienced and knowledgeable market analysts.

Primary Research

For the primary research, Market Research Future (MRFR) conducted comprehensive online and offline surveys. This was done to understand the dynamics of the Molecular Modelling Market and to get an in-depth insight into the industry players and their strategies. MRFR interacted with industry professionals, such as CEOs, vice presidents, product managers, directors, and other C-level executives. Along with this, the primary research team interviewed industry leaders, market experts, and opinion leaders to understand the industry perspective and obtain valuable insights.

Secondary Research

MRFR used a wide range of secondary data sources for the secondary research component including directories, databases, company annual reports, industry magazines, corporate presentations, and peer-reviewed journals. The secondary research was used to validate the primary research findings and to cross-check the data collected from the primary sources. Moreover, secondary sources were used to thoroughly understand the industry chain structure, market dynamics, value chain analysis, competitive landscape, SWOT analysis, and market size.

Data Collection and Analysis

The primary research activities provided data on market trends, competitive dynamics, and market estimates during the forecast period. This data was collected through interviews, surveys, and analysis through credible resources. After the primary data collection, MRFR analysed the data through various models to understand the various market dynamics and did an extensive analysis of the data collected to create detailed market analysis documents, tables, and figures.

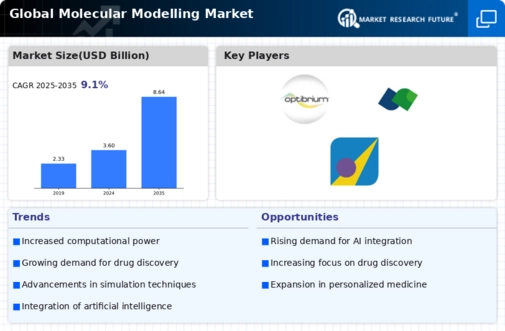

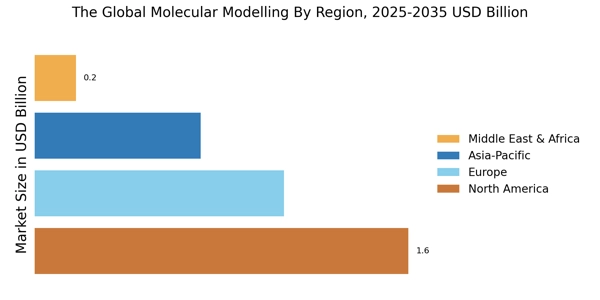

Scope of the Report

The report on the Molecular Modelling Market provides a detailed assessment and insights into the current market trends, market size and forecast, and other relevant factors to provide in-depth coverage of the market from 2023 to 2030. The market includes market estimations, through primary and secondary research, which includes market drivers and restraints and opportunities, segmental and regional market presence. In addition, the market report also includes information about the competitive environment in the Molecular Modelling Market and provides market attractiveness analysis for the various regional and segmental markets.