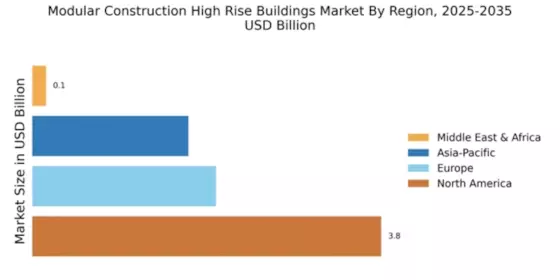

North America : Market Leader in Modular Construction

North America is poised to maintain its leadership in the Modular Construction High Rise Buildings Market, holding a market size of $3.8 billion as of December 2025. The region's growth is driven by increasing urbanization, a push for sustainable building practices, and favorable regulations that encourage modular construction. The demand for faster project completion and cost efficiency further fuels this trend, making modular construction an attractive option for developers. The competitive landscape in North America is robust, featuring key players such as Katerra, Turner Construction, and Z Modular. The U.S. stands out as the leading country, with significant investments in modular technology and infrastructure. The Modular Building Institute plays a crucial role in promoting industry standards and best practices, ensuring that the market continues to evolve and meet the growing demands of urban development.

Europe : Emerging Market with Growth Potential

Europe is witnessing a significant rise in the Modular Construction High Rise Buildings Market, with a market size of €2.0 billion projected for December 2025. The region's growth is propelled by stringent environmental regulations and a strong emphasis on sustainability. Countries are increasingly adopting modular construction to meet housing demands while minimizing carbon footprints, thus driving market expansion. The European Union's initiatives to promote green building practices further catalyze this trend. Leading countries in this market include Germany, the UK, and France, where companies like Skanska and Bouygues Construction are making substantial contributions. The competitive landscape is characterized by a mix of established firms and innovative startups, all vying for a share of the growing market. The Modular Building Institute's efforts in Europe are vital for fostering collaboration and innovation within the sector.

Asia-Pacific : Rapid Growth in Construction Sector

The Asia-Pacific region is emerging as a significant player in the Modular Construction High Rise Buildings Market, with a market size of $1.7 billion expected by December 2025. The rapid urbanization and increasing population density in countries like China and India are key drivers of this growth. Additionally, government initiatives aimed at improving infrastructure and housing are creating a favorable environment for modular construction, which offers speed and efficiency in project delivery. China leads the region in modular construction, with substantial investments from companies like Lendlease and Factory OS. The competitive landscape is evolving, with both local and international players entering the market. As the demand for affordable housing rises, modular construction is becoming a viable solution, positioning the Asia-Pacific region for continued growth in this sector.

Middle East and Africa : Emerging Opportunities in Construction

The Middle East and Africa region is at the nascent stage of the Modular Construction High Rise Buildings Market, with a market size of $0.15 billion as of December 2025. The growth in this region is primarily driven by rapid urbanization and the need for efficient construction methods to meet the demands of a growing population. Governments are increasingly recognizing the benefits of modular construction, leading to supportive policies and investments in infrastructure development. Countries like the UAE and South Africa are leading the charge in adopting modular construction techniques. The competitive landscape is gradually evolving, with both local firms and international players exploring opportunities in this market. As the region continues to develop, modular construction is expected to play a crucial role in addressing housing shortages and enhancing urban infrastructure.