世界の高層ビル向けモジュラー建設市場の概要

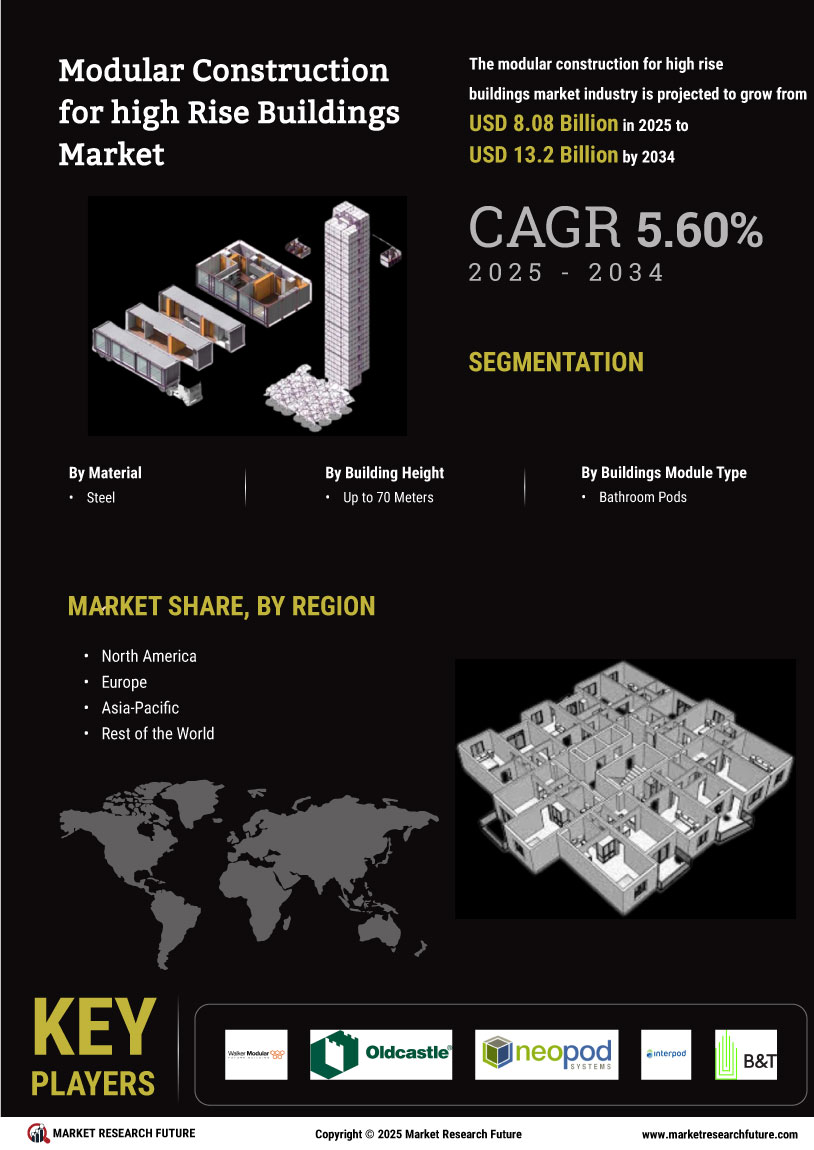

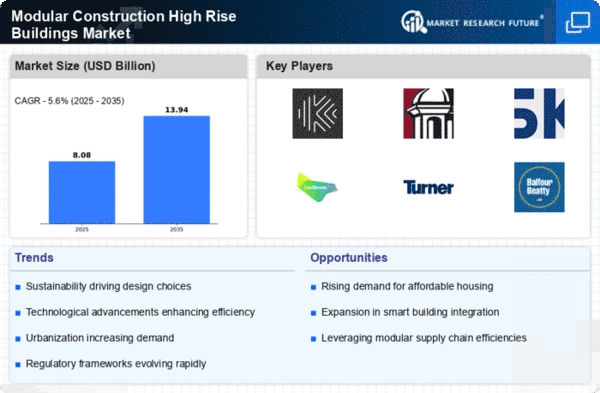

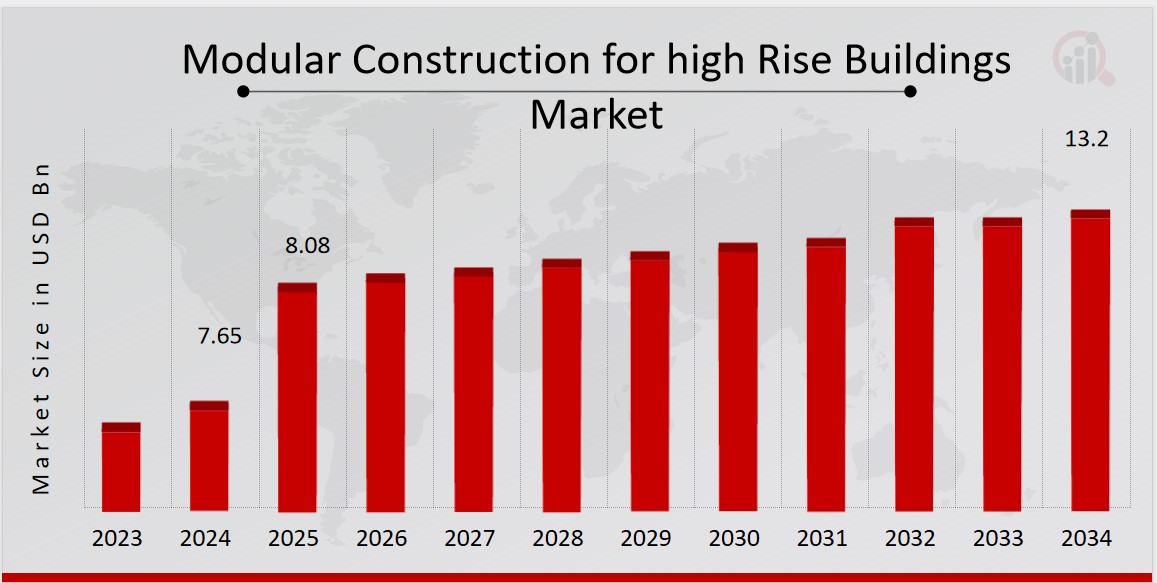

p高層ビル向けモジュラー建設市場規模は、2024年に76億5,000万米ドルと評価されました。高層ビル向けモジュラー建設市場産業は、2025年の80億8,000万米ドルから2034年には132億米ドルに成長すると予測されており、予測期間(2025~2034年)中に5.60%の年平均成長率(CAGR)を示します。発展途上国における都市化と工業化の進展は、世界的な高層ビル向けモジュラー建設産業の成長を促進する主要な市場推進要因です。人口爆発も、高まる消費者需要を満たすための市場拡大に大きな影響を与えると予測されています。

出典:二次調査、一次調査、MRFRデータベース、アナリストレビュー

高層ビル向けモジュラー建設市場の動向

ul-

急速な都市化と工業化、そして建設の加速と高い生産性が市場の成長を牽引しています

高層住宅と商業ビルの両方のモジュラー建設では、高性能材料が使用されています。高性能構造に対する長期的な需要と建設要件は、これらの製品によって満たされ、建物の効率性、耐久性、適応性が向上します。さらに、モジュラー建設には、優れた品質、耐久性、魅力的なデザインなど、多くの利点があります。住宅、ビジネス、駐車場の建設はすべて、これらの利点を利用できます。さらに、モジュラー木造建築は、エネルギー消費量が少なく、維持管理が少なく、総費用が削減されるため、非常に好まれています。

インフラ投資の必要性は世界中で大幅に高まっていますが、特に発展途上国で顕著です。世界は2014年から2025年の間にインフラに約78兆米ドルを費やすと予想されています。さらに、インフラ支出は金融危機から立ち直り、2025年までに年間5兆米ドル以上増加すると予想されています。インド、日本、インドネシア、ナイジェリア、メキシコ、中国などの発展途上国の都市への移住者が増えるにつれて、住宅や企業などのインフラへの支出が増加すると予想されています。さらに、高層ビルのモジュール建設は、構造的安定性の向上、柔軟性の向上、廃棄物の削減、より迅速かつ高品質な建設、労働力の削減など、多くの利点から人気が高まっています。これらすべての利点により、多くの新しい競争者が前述の業界で運試しをし、拡大を利用して大きな利益を生み出そうとしています。その結果、より多くの専門家や新興企業が高層ビルのモジュール建設市場に参入し、主要プレーヤーとしての地位を確立しようとしています。したがって、高層ビル向けモジュラー建設市場の収益を押し上げます。

高層ビル向けモジュラー建設市場セグメントの洞察

h3高層ビル向けモジュラー建設 材料の洞察 p材料に基づく高層ビル向けモジュラー建設市場区分には、鋼鉄が含まれます。 鋼鉄セグメントが市場を支配しました。 4 面、オープン サイド、階段またはエレベーター専用のモジュール、重量を支えないモジュールも、鋼鉄ビルの建設に使用されます。 鋼鉄モジュラー建設は、その強度と長寿命により、駐車場、多目的商業および小売スペース、住宅に適しています。 これらの要素により、市場参加者は今後数年間で企業をレベルアップする絶好の機会が得られます。高層ビル向けモジュラー建設 建物の高さの洞察

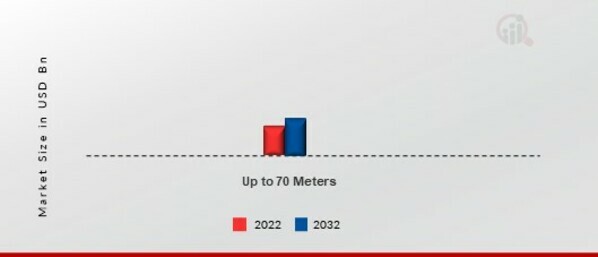

p建物の高さに基づく高層ビル向けモジュラー建設市場区分には、最大 70 メートルが含まれます。高さ70メートルまでのカテゴリーが最も高い収益を生み出しました。高層構造物に関しては、高さ70メートルまでの構造物にはモジュラー建設が実用的な選択肢となり得ます。この高さの範囲では、プレハブモジュールの輸送、物流、設置においてより柔軟性と利便性が高まります。高さ70メートルまでの高層構造物では、モジュラー建設により大幅な時間とコストの節約が実現します。図1:高層ビル市場向けモジュラー建設、建物の高さ別、2022年および2032年(10億米ドル)

出典:二次調査、一次調査、MRFRデータベース、アナリストレビュー

高層ビル向けモジュラー建設 モジュールタイプの洞察

pモジュールタイプに基づく高層ビル向けモジュラー建設市場の区分には、バスルームポッドが含まれます。バスルームポッドセグメントが市場を支配しました。バスルームポッドと呼ばれるプレハブモジュールは、建設現場から離れた管理された製造環境で製造されます。このオフサイト製造方法により、正確な施工、一貫した品質管理、そして人員と資源の有効活用が可能になります。バスルームポッドを他のモジュールと並行して製造することで、総工期を短縮できます。高層ビル向けモジュール建築:地域別分析

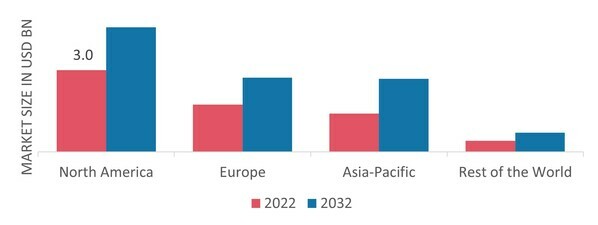

p本調査では、北米、ヨーロッパ、アジア太平洋、その他の地域における市場分析を提供しています。北米の高層ビル向けモジュール建築市場が、この市場を牽引するでしょう。この地域では、迅速な建物修繕と、安価で持続可能な住宅へのニーズが高まっています。都市化、人口増加、そして経済的で環境に優しい建物へのニーズの高まりから、モジュラー建設技術を用いた高層ビルの建設が増えています。さらに、市場レポートで調査されている主要国は、米国、カナダ、ドイツ、フランス、英国、イタリア、スペイン、中国、日本、インド、オーストラリア、韓国、ブラジルです。

図 2:高層ビル向けモジュラー建設市場シェア 2022 年地域別(10億米ドル)

出典:二次調査、一次調査、MRFRデータベース、アナリストレビュー

ヨーロッパの高層ビル向けモジュラー建設市場は、2番目に大きな市場シェアを占めています。この地域では、環境に優しい建築方法、厳格な建築基準、住宅不足の緩和の必要性が重視されており、これらによりモジュラー建設の需要が高まっています。さらに、変化する都市環境に合わせて変化できる創造的で適応性の高い建設ソリューションに対する需要が、ヨーロッパの主要な市場推進力となっています。さらに、ドイツの高層ビル向けモジュラー建設市場は最大の市場シェアを占め、英国の高層ビル向けモジュラー建設市場はヨーロッパ地域で最も急速に成長している市場でした。

アジア太平洋地域の高層ビル向けモジュラー建設市場は、2023年から2032年にかけて最も高いCAGRで成長すると予想されています。アジア太平洋地域では、急速な都市化と人口増加により、高層構造物の需要が高まっています。迅速かつ効果的な建設の需要を満たすことができるため、モジュラー建設はこの地域で人気が高まっています。住宅問題の解決、建設時間の短縮、建設品質の向上のため、中国、インド、シンガポールなどの国はモジュラー建設技術に投資しています。高層構造物のモジュラー建設市場は、この分野で大きな成長の可能性を秘めています。さらに、中国の高層ビル向けモジュラー建設市場は最大の市場シェアを占め、インドの高層ビル向けモジュラー建設市場はアジア太平洋地域で最も急速に成長している市場でした。

高層ビル向けモジュラー建設の主要市場プレーヤー競合分析

p主要市場プレーヤーは、製品ラインの拡充を目指し、研究開発に多額の投資を行っています。これにより、高層ビル向けモジュール建築市場のさらなる成長が期待されます。市場参加者は、新製品の発売、契約締結、合併・買収、投資拡大、他社との連携など、重要な市場動向を踏まえ、事業展開を拡大するための様々な戦略的活動にも取り組んでいます。競争が激化し、市場が拡大する中で生き残るためには、高層ビル向けモジュール建築業界はコスト効率の高い製品を提供する必要があります。現地で製造して運用コストを最小限に抑えることは、高層ビル向けモジュール建築業界のメーカーが顧客に利益をもたらし、市場セクターを拡大するために使用する主要なビジネス戦術の 1 つです。近年、高層ビル向けモジュール建築業界は、市場にいくつかの最も重要な利点を提供しています。研究開発業務に投資することで市場の需要を拡大しようとしている高層ビル向けモジュール建築市場の主要プレーヤーには、Walker Modular、Euro components Italia SPA、PUDA Industrial Co Ltd、Old castle Superpods、Neopod Systems、Intelligent Offsite、Interpod Offsite、The Pod System、B and T Manufacturing、Elements Europe などがあります。

台湾では、PUDA は最大のプレハブバスルームメーカーであり、日本では、PUDA はプレハブバスルームのトップブランドです。ホテル、住宅、病院などの施設で同社の製品が頻繁に採用されています。中東、オーストラリア、日本への輸出経験は10年以上。リゾート、住宅、病院などで頻繁に利用されています。25年以上の専門知識を持つPUDAは、カスタマイズされたバスルームポッドで有名で、最先端の製造技術、独自の研究開発計画、最先端のデザイン、組み立てプロセスを活用して、大容量のカスタマイズされたプレハブバスルームソリューションの作成をリードしてきました。

モジュール式バスルームを組み込んだInterpod offsiteは、複雑な現場プロジェクトをよりスマートにします。同社のバスルームポッドは12のウェットエリア取引をオフサイトにするため、建設業者や開発業者は予定よりも早くプロジェクトを完了することに集中できます。オーストラリアとニュージーランドの顧客向けの31,000を超える高品質のバスルームは、バスルームポッド製造に注力した結果です。同社は建設業者や開発業者と協力し、建設コストの削減と長期的な開発収益の向上に取り組んでいます。

高層ビル向けモジュラー建設市場における主要企業には、以下が含まれます。

ul- Walker Modular

- Euro components Italia SPA

- Old castle Superpods

- Intelligent Offsite

- Interpod Offsite

- The Podシステム

- T Manufacturing

- Elements Europe

高層ビル向けモジュラー建設市場セグメンテーション

h3高層ビル向けモジュラー建設 材料展望 (10億米ドル、2018年~2032年) ul- スチール

- 最大70メートル

- バスルームポッド

- 北米

- 米国

- カナダ

- ヨーロッパ

- ドイツ

- フランス

- イギリス

- イタリア

- スペイン

- ヨーロッパのその他の地域

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 南韓国

- オーストラリア

- その他のアジア太平洋地域

- 世界のその他の地域

- 中東

- アフリカ

- ラテンアメリカ

FAQs

How much is the modular construction for high rise buildings market?

The modular construction for high rise buildings market size was valued at USD 6.5 Billion in 2022.

What is the growth rate of the modular construction for high rise buildings market?

Modular Construction High Rise Buildings Market is expected to grow with a CAGR of 5.6% in the period 2025-2035

Which region held the largest market share in the modular construction for high rise buildings market?

North America had the largest share in the Modular Construction for High Rise Buildings Market

Who are the key players in the modular construction for high rise buildings market?

The key players in the market are Walker Modular, Euro components Italia SPA, PUDA Industrial Co Ltd, Old castle Superpods, Neopod Systems, Intelligent Offsite, Interpod Offsite, The Pod System, B and T manufacturing and Elements Europe.

Which material led the modular construction for high rise buildings market?

The steel category dominated the Modular Construction for High Rise Buildings Market in 2022.

Which module type had the largest market share in the modular construction for high rise buildings market?

The bathroom pods category had the largest share in the Modular Construction for High Rise Buildings Market

このレポートの無料サンプルを受け取るには、以下のフォームにご記入ください

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”