Market Trends

Key Emerging Trends in the Modular Construction High Rise Buildings Market

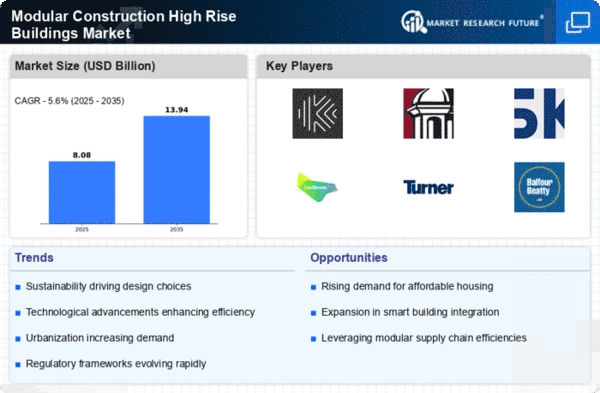

The market patterns of modular construction for high-rise buildings are seeing a critical rise, driven by different elements that upgrade productivity, manageability, and cost-viability. This imaginative way to deal with construction is reshaping the land scene, with key markers pointing towards a promising future. Modular construction empowers high-rise buildings to be raised at an exceptional speed. The utilization of pre-assembled modules, developed off-site, considers equal work streams. This lessens in general construction time, fulfilling the developing need for appropriate undertaking delivery. The modular construction approach frequently brings about cost investment funds. By smoothing out the assembling process, limiting material waste, and exploiting economies of scale, engineers can accomplish a more spending plan friendly construction model contrasted with conventional techniques. This cost-viability is a vital driver in the rising reception of modular strategies. Modular construction offers modelers and engineers expanded plan adaptability. The capacity to fine-tune modules considers one of a kind and imaginative structure plan, testing the judgement that modular construction brings about uniform, box-like designs. This adaptability draws in designers looking to make high-rise buildings that are out on the lookout. The controlled climate of off-site manufacturing guarantees a higher level of value control. Every module goes through thorough testing and assessments during creation, limiting the possibilities of deformities. This quality affirmation is interesting to engineers and financial sponsors who focus on long haul strength and dependability in high-rise constructions. Throughout the long term, there has been a perceptual shift with respect to modular construction. At first connected with transitory or bad quality designs, modular procedures are acquiring acknowledgment for high-rise buildings. This adjustment of discernment is driven by effective contextual analyses, expanded consciousness of the advantages, and progressions in modular construction innovation. The modular construction pattern supports coordinated effort between different partners, including designers, specialists, producers, and project workers. This cooperative methodology smoothes out the construction process, encourages development, and guarantees that all gatherings are lined up with the task objectives, adding to the progress of modular high-rise projects.

Leave a Comment