Growth of Mobile Gaming

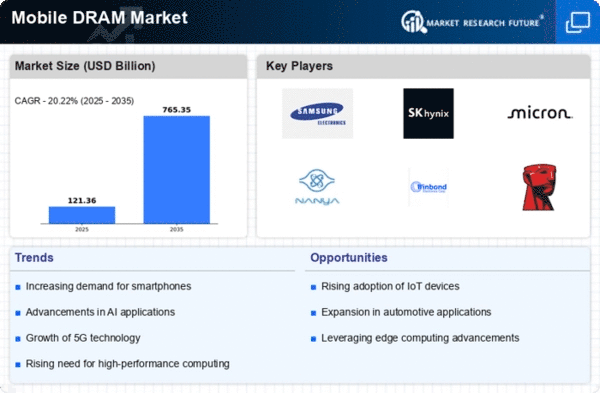

The Global Mobile DRAM Market Industry is significantly influenced by the rapid expansion of the mobile gaming sector. With the increasing popularity of mobile games, which often require substantial memory resources for optimal performance, the demand for high-capacity DRAM is on the rise. As mobile gaming revenues continue to grow, driven by both casual and competitive gaming, manufacturers are likely to prioritize the development of DRAM solutions tailored for this market. This trend is expected to contribute to the overall market growth, with projections indicating a compound annual growth rate of 20.22% from 2025 to 2035. The integration of advanced graphics and real-time processing in mobile games further underscores the necessity for robust memory solutions.

Emergence of IoT Devices

The Global Mobile DRAM Market Industry is also experiencing growth due to the proliferation of Internet of Things (IoT) devices. As more devices become interconnected, the demand for mobile DRAM is likely to increase, as these devices often require efficient memory solutions to handle data processing and communication tasks. The rise of smart home technologies, wearables, and connected vehicles necessitates the use of advanced memory technologies to ensure seamless operation and data management. This trend suggests a potential expansion of the market as manufacturers adapt their offerings to cater to the unique requirements of IoT applications, thereby enhancing the overall market landscape.

Market Growth Projections

The Global Mobile DRAM Market Industry is projected to experience substantial growth over the next decade. With a market valuation of 101.0 USD Billion in 2024, the industry is expected to reach approximately 765.2 USD Billion by 2035. This remarkable growth trajectory suggests a compound annual growth rate of 20.22% from 2025 to 2035. Factors contributing to this growth include the rising demand for smartphones, the expansion of mobile gaming, and advancements in AI technologies. As manufacturers continue to innovate and adapt to changing consumer preferences, the market is likely to evolve, presenting new opportunities for stakeholders within the industry.

Rising Demand for Smartphones

The Global Mobile DRAM Market Industry experiences a substantial surge in demand driven by the increasing adoption of smartphones worldwide. As of 2024, the market is valued at approximately 101.0 USD Billion, reflecting the growing consumer preference for high-performance mobile devices. This trend is further fueled by advancements in mobile technology, which necessitate enhanced memory capabilities for applications such as gaming, streaming, and multitasking. The proliferation of 5G technology also contributes to this demand, as it enables faster data processing and connectivity, thereby requiring more efficient memory solutions. Consequently, manufacturers are compelled to innovate and expand their production capacities to meet this escalating demand.

Advancements in AI and Machine Learning

The Global Mobile DRAM Market Industry is poised for growth due to the increasing integration of artificial intelligence and machine learning technologies in mobile devices. These technologies require significant memory resources to process data efficiently, thus driving the demand for high-performance DRAM. As mobile devices become more intelligent, capable of performing complex tasks, the need for advanced memory solutions becomes paramount. This trend is expected to enhance the overall user experience, leading to greater consumer satisfaction and increased sales of mobile devices. The anticipated growth in this sector may further bolster the market, as manufacturers innovate to meet the evolving requirements of AI-driven applications.

Increased Focus on High-Performance Computing

The Global Mobile DRAM Market Industry is witnessing a shift towards high-performance computing in mobile devices. As consumers demand faster processing speeds and improved multitasking capabilities, manufacturers are compelled to develop DRAM solutions that can meet these expectations. This trend is particularly evident in flagship smartphones and tablets, which often incorporate cutting-edge memory technologies to enhance performance. The anticipated growth in this segment is expected to contribute to the overall market expansion, with projections indicating a market value of 765.2 USD Billion by 2035. The continuous evolution of mobile applications and services further drives the need for high-performance memory solutions.