Rising Demand for Rental Services

The Mobile Construction Cranes Market is witnessing a shift towards rental services, driven by cost-effectiveness and flexibility. Many construction companies are opting to rent cranes rather than purchase them outright, as this approach allows for better allocation of capital and reduces maintenance responsibilities. The rental market for construction equipment, including mobile cranes, is projected to grow significantly, with estimates suggesting a compound annual growth rate of around 7% in the coming years. This trend is particularly evident in regions experiencing rapid construction growth, where companies prefer to rent equipment to adapt to fluctuating project demands. As a result, rental service providers are likely to expand their fleets and enhance service offerings, further stimulating the Mobile Construction Cranes Market.

Sustainability Initiatives in Construction

Sustainability initiatives are increasingly influencing the Mobile Construction Cranes Market, as companies strive to reduce their environmental footprint. The demand for eco-friendly construction practices is prompting manufacturers to develop cranes that utilize alternative energy sources, such as electric and hybrid models. These cranes not only minimize emissions but also reduce operational costs over time. Additionally, regulatory frameworks are becoming more stringent, pushing construction firms to adopt greener technologies. Recent statistics indicate that the market for sustainable construction equipment, including mobile cranes, is expected to witness a growth rate of around 6% annually. This trend suggests that companies prioritizing sustainability will likely enhance their market position within the Mobile Construction Cranes Market, appealing to environmentally conscious clients and stakeholders.

Urbanization and Infrastructure Development

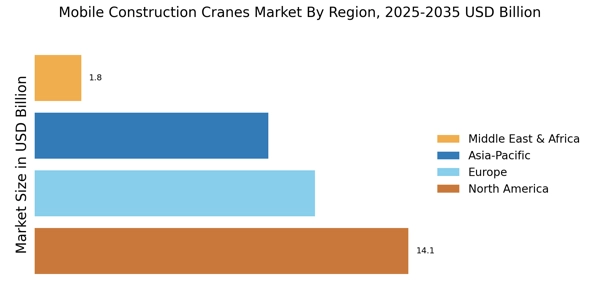

The ongoing trend of urbanization and infrastructure development is a significant driver for the Mobile Construction Cranes Market. As cities expand and populations grow, there is an increasing need for residential, commercial, and transportation infrastructure. This surge in construction activities necessitates the use of mobile cranes, which are essential for lifting heavy materials and facilitating complex construction tasks. Recent data indicates that urban areas are expected to account for over 70% of the global population by 2050, leading to a substantial increase in construction projects. Consequently, the demand for mobile cranes is projected to rise, as construction companies seek efficient solutions to meet the growing infrastructure needs. This trend underscores the critical role of mobile cranes in shaping the future of urban landscapes within the Mobile Construction Cranes Market.

Increased Investment in Construction Projects

Increased investment in construction projects is a pivotal driver for the Mobile Construction Cranes Market. Governments and private entities are allocating substantial funds towards infrastructure development, including roads, bridges, and commercial buildings. This influx of capital is expected to boost construction activities, thereby elevating the demand for mobile cranes. Recent reports indicate that global construction spending is anticipated to reach trillions of dollars in the next few years, with a significant portion dedicated to enhancing urban infrastructure. As construction firms ramp up their operations to meet these demands, the reliance on mobile cranes for efficient project execution will likely intensify. This trend highlights the crucial role of mobile cranes in supporting the ambitious construction goals set forth by various stakeholders within the Mobile Construction Cranes Market.

Technological Advancements in Mobile Construction Cranes

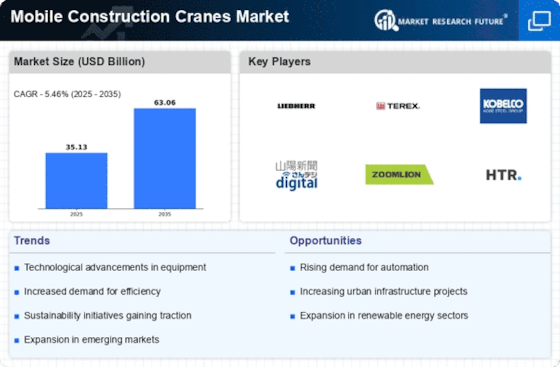

The Mobile Construction Cranes Market is experiencing a notable transformation due to rapid technological advancements. Innovations such as telematics, automation, and advanced control systems are enhancing the efficiency and safety of crane operations. For instance, the integration of IoT technology allows for real-time monitoring of crane performance, which can lead to reduced downtime and improved maintenance schedules. Furthermore, the adoption of electric and hybrid cranes is gaining traction, aligning with the industry's shift towards sustainability. According to recent data, the market for mobile cranes is projected to grow at a compound annual growth rate of approximately 5.2% over the next few years, driven by these technological improvements. As a result, companies that invest in modernizing their fleets are likely to gain a competitive edge in the Mobile Construction Cranes Market.